Stocks swung wildly last week shortened by the Labor Day holiday. The week’s outcome, however, resembled the result of the previous week. The S&P 500 posted its second straight weekly loss. The materials sector was the top performer, once again managing to buck the broad market decline.

The decline in stock prices continued from the previous week on valuation concerns. Market leaders Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Facebook (FB), Microsoft (MSFT), and Tesla (TSLA) lost more than $1 trillion in market value over the three days ending on September 8. This decline attracted bargain hunters, and the S&P 500 surged 2% on September 9. The rally, however, fizzled out.

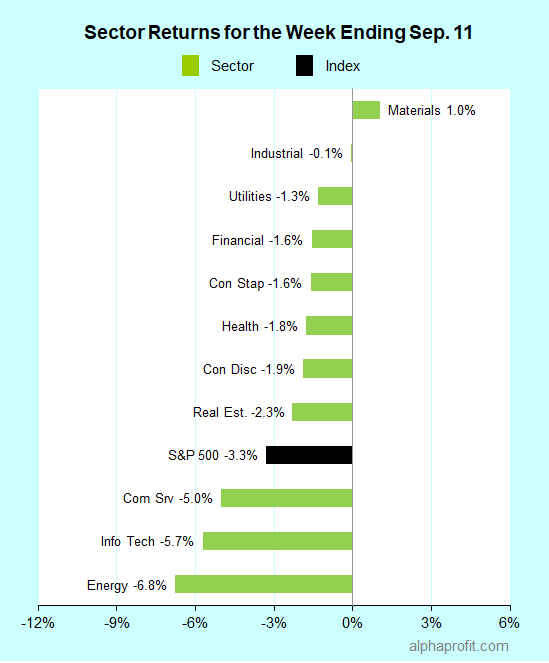

For the week ending September 11, the S&P 500 (SPY) fell 3.3% after losing 2.3% the week before.

Ten of the 11 sectors declined.

Materials (XLB) led the performance chart for the second week in a row. It was the only sector to finish in the black for the week.

Industrials (XLI) and utilities (XLU) held up better than the S&P 500.

Energy (XLE), information technology (XLK), and communication services (XLC) lagged the S&P 500.

The number of declining stocks in the S&P 500 beat advancers by a wide 8-to-3 ratio.

The S&P 500’s top 20 winners included companies from the consumer discretionary, industrials, and materials sectors.

1. Consumer discretionary: Tapestry (TPR) and PVH Corp. (PVH)

Tapestry (TPR) was the week’s top performer in the S&P 500, rising 10%. Shares of the luxury accessories & footwear designer rose after Exane BNP Paribas initiated coverage with an Outperform rating and set a $24 price target. Bullish options trading activity also helped the advance.

Shares of apparel maker PVH Corp. (PVH) rose 9% after analysts at Citigroup (C) & Cowen (COWN) upgraded them. PVH shares were up 11% the week before when the company surprised investors reporting a profit.

2. Industrials: Fortive Corp. (FTV)

Fortive (FTV) shares rose 4% after the industrial instrumentation & automation enabler raised its third-quarter revenue forecast. Better-than-expected performance in the first two months of the quarter prompted the company to up its guidance. Several analysts raised their Fortive price targets.

3. Materials: LyondellBasell Industries (LYB) and Sherwin-Williams (SHW)

LyondellBasell Industries (LYB) and Sherwin-Williams (SHW) shares rose 5% and 4%, respectively, after analysts nudged their current year and next year earnings estimate higher. LyondellBasell’s gains came on the back of a 6% advance the week before.

Alternative assets aligned with the materials sector, namely commodity-oriented exchange-traded products (ETPs), performed well last week. The winners included:

- Livestock ETN (COW) up 6%

- Platinum ETF (PPLT) up 4%

- Corn ETF (CORN) up 4%

Looking ahead to the week of September 14

* The Federal Reserve takes center stage, with its interest rate policy-setting Federal Open Market Committee holding its last meeting before the presidential election. The Fed is expected to update its economic & interest rate outlooks and introduce its 2023 forecasts. Whether Wall Street will get the insights it hopes for on balance sheet adjustments, bond purchase targets, and yield curve controls remain to be seen.

* August retail sales take the spotlight in economic data as they provide a reading on consumer spending in the absence of the boost from enhanced unemployment benefits. With Congress unlikely to come through with additional stimulus, investors will keep a close watch on the trend in weekly jobless claims.

* Recent weakness in price has not deterred new supply from coming to market. Several initial public offerings (IPOs) are expected next week. Data warehousing platform Snowflake (SNOW), game development platform Unity Software (U), and food packing producer Pactiv Evergreen (PCTV) are among the larger offerings expected to debut.

* Three S&P 500 members, Adobe (ADBE), FedEx (FDX), and Lennar (LEN) are scheduled to report their quarterly earnings.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023