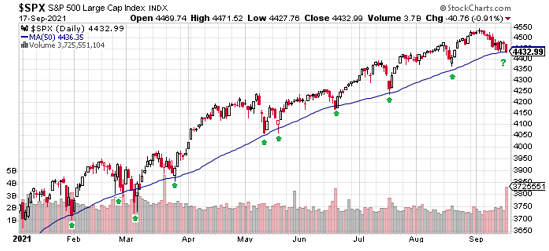

There was little incentive for buyers to step in and prop up stock prices last week. Investors worried about the possibility of higher corporate tax rates crimping profits. Retail sales muddied an otherwise consistent picture of the economy losing momentum. The decline in stocks pushed the S&P 500 to its 50-day moving average, with the FOMC scheduled to meet this week and the trading calendar embarking on a seasonally weak period.

Congress returned to Washington after recess. House Democrats proposed higher taxes on corporations and wealthy Americans to fund President Biden’s $3.5 trillion budget package. The proposal raises the corporate tax rate to 26.5% from 21.0%.

In economic data, retail sales were an outlier, with other data pointing to slowing economic growth. The Census Bureau reported August retail sales rose 0.7% compared to economists’ forecast for a 0.8% decline.

Initial claims for unemployment benefit claims of 332,000 exceeded economists’ forecasts by 12,000. The University of Michigan’s consumer sentiment measure clocked just 71, continuing to hover near a 10- year low.

The news on the inflation front was somewhat calming. The consumer price index rose 0.3% in August. Economists surveyed by Dow Jones expected the CPI to increase by 0.4%. The annual increase in the CPI stood at 5.3% in August, keeping inflation at the highest level in about 13 years.

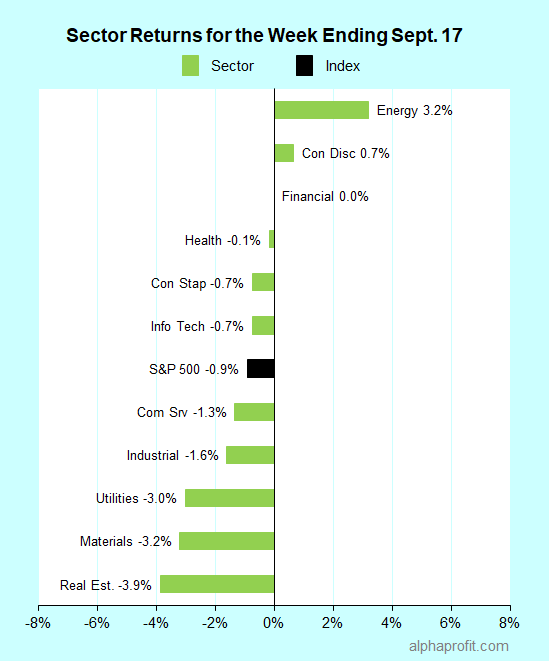

For the week ending September 17, the S&P 500 (SPY) fell 0.9%. Only two of the 11 sectors gained.

Energy (XLE), consumer discretionary (XLY), and financials (XLF) outperformed the S&P 500.

Real estate (XLRE), materials (XLB), and utilities (XLU) lagged the benchmark.

Market breadth was negative. The number of declining stocks in the S&P 500 led the number of advancers by a 3-to-2 ratio.

The S&P 500’s top 10 winners included communication service, consumer discretionary, energy, financial, health care, and materials companies.

1. Energy

Oil & gas producers fared well. The price of oil rose 3.2% for the week to close above $70 a barrel. The U.S. Energy Information Administration said U. S. crude oil stockpiles fell to the lowest level since September 2019 as hurricanes Nicholas and Ida reduced offshore production by 26 million barrels. Prospects of U. S. oil demand increasing with the decline in new COVID cases and OPEC’s forecast for oil demand to exceed pre-pandemic levels next year supported the advance.

EOG Resources (EOG) gained 11% to be the top performer in the S&P 500 for the week. Tudor Pickering upgraded the oil & gas producer to Buy from Hold, setting an $82 price target.

Diamondback Energy (FANG) rose 10% after announcing a $2 billion stock buyback as part of its plan to return 50% of free cash flow to shareholders in the fourth quarter.

Occidental Petroleum (OXY) and APA Corp. (APA) were the two other oil & gas producers among the top 10 winners. They gained 8% each.

2. Health Care

Centene Corp. (CNC) +8% – The health care provider gained on unsubstantiated merger talk and general strength among health care provider peers. Mizuho and Morgan Stanley brokerages raised their price targets on Centene.

Incyte Corp. (INCY) +7% – The biotech company received conditional approval for pemigatinib in treating bile duct cancer. Incyte also announced it would present trial data for its cream in treating vitiligo and atopic dermatitis at the European Academy of Dermatology and Venereology.

3. Materials

CF Industries (CF) +8% – The fertilizer producer gained after Bank of America reiterated its Buy recommendation and raised the CF share price target to $67, implying over 40% upside. Bank of America attributed the higher price target partly to the possibility of China banning fertilizer exports.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Telecom service provider Lumen Technologies (LUMN) +8%

- Auto manufacturer Ford Motor Co.(F) +7%

- Asset Manager Invesco Ltd. (IVZ) +7%

Top ETFs for the week

The following ETFs themes worked well: oil & gas, cannabis, airlines, solar energy, and health care providers. The top ETFs for the week include:

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +5.1%

- AdvisorShares Pure US Cannabis ETF (MSOS) +4.3%

- U.S. Global Jets ETF (JETS) +2.4%

- Invesco Solar ETF (TAN) +2.3%

- iShares U.S. Healthcare Providers ETF (IHF) +2.3%

Top Fidelity Fund for the week

- Fidelity Select Natural Gas (FSNGX) +3.4%

Looking ahead to the week of September 20

The S&P 500 starts off the seasonally unfavorable period, perched at its 50-day moving average. The Federal Reserve’s interest rate policy meeting is the main event of the week. Congress continues to work on the budget. Investors are looking to earnings reports from global companies like FedEx and Nike to get a handle on supply chain bottlenecks and inflation.

* Stocks have declined in the closing days of September in many years. The S&P 500 starts the trading week just four points below its 50-day moving average. Stocks have held support at the 50-day moving average on nine occasions in 2021, including early March. In early March, the benchmark managed to regain its footing in a matter of days after breaking support at the 50-day moving average. How stocks fare this week depends on what the Federal Open Market Committee and Congress do or do not.

* The Federal Open Market Committee begins its interest rate policy meeting on Tuesday. In light of recent data, economists expect the Fed to defer the announcement on tapering bond purchases to November after discussing the topic at the September meeting. The Fed’s new economic projections and interest rate forecast, i.e., the dot plot, released on Wednesday, can influence financial markets even if the comments on tapering do not. Stock and bond prices could react negatively if the dot plot shows interest rates rising sooner than previously forecasted.

* Congress continues work on the $3.5 trillion budget including infrastructure spending. As such, the proposal for higher taxes will remain in focus and can become worrisome. Calls to raise the debt ceiling are also likely to become louder in a bid to allow the Treasury to issue more debt.

* Accenture, Adobe, Costco, FedEx, and Nike are among the S&P 500 index members reporting earnings this week. With COVID continuing to disrupt supply chains and the resulting part shortages leading to inflation, investors will look to comments from freight & logistics provider FedEx and global footwear & accessories brand Nike to understand the status of supply chain bottlenecks. Earnings reports from Accenture and Adobe can provide investors insights on trends impacting the information technology industry.

* A relatively light economic calendar puts the spotlight on the housing industry. Housing starts, building permits, and sales of existing and new homes are due this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

[wbcr_html_snippet id=”16491″]

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023