Stocks were unable to sustain the gains provided by enthusiasm from M&A activity. The Federal Reserve’s somber assessment of the economy stoked concerns of an extended period of sluggish economic growth. Rising testiness in Sino-American relations also weighed on stocks, pushing the S&P 500 for its third straight weekly loss.

A couple of mega-deals boosted investor confidence and helped stocks get out of the blocks quickly last week. NVIDIA (NVDA) offered $40 billion to buy chipmaker ARM Holdings from Softbank. Gilead Sciences’ (GILD) $21 billion offer to buy biotech firm Immunomedics (IMMU) represented a 100% premium.

The advance faltered after the Federal Reserve indicated it would keep rates near zero through at least 2023. The central bank warned of risks to the economy from COVID19 without additional fiscal stimulus. Fed Chairman Powell called ongoing unemployment and the uptick in evictions & foreclosures as ‘things that will scar the economy’ without further support from Congress.

The U.S. Commerce Department said it is prohibiting transactions involving Tencent’s WeChat and Bytedance’s TikTok. The uncertainty cast on the proposed transactions involving TikTok and Oracle dampened market sentiment. The U. S. government said it would block all TikTok and WeChat downloads in the country starting Sunday.

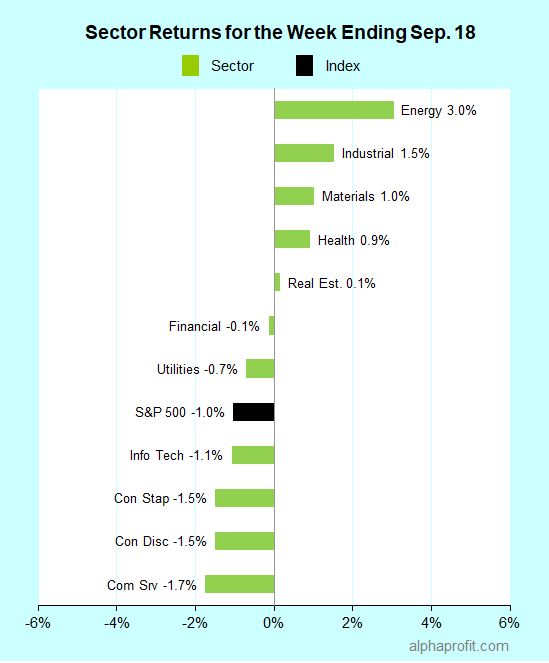

For the week ending September 18, the S&P 500 (SPY) fell 1.0%, its third straight weekly decline.

Five of the 11 sectors ended above the flatline.

Energy (XLE), industrials (XLI), and materials (XLB) led the performance chart.

Communication services (XLC), consumer discretionary (XLY), and consumer staples (XLP) lost the most.

Breadth was, however, positive as the number of advancing stocks in the S&P 500 beat decliners by a 3-to-2 ratio.

The S&P 500’s top 10 winners included companies from the industrial, energy, and information technology sectors.

1. Industrials: General Electric (GE)

General Electric (GE) shares surged 16% to be the week’s top performer. CEO Culp said the industrial giant would be cash flow positive in the back half of 2020, several months earlier than forecast in July.

2. Energy: Diamondback Energy (FANG), Occidental Petroleum (OXY), and TechnipFMC (FTI)

The price of oil rose 10% to $41.11 a barrel on a combination of oil production outages due to Hurricane Sally and rising hope of OPEC members complying with their production quotas. Saudi Arabia rebuked OPEC members for violating production quotas. Analysts at Goldman Sachs and UBS predicted a deficit in oil supplies.

Supported by a rise in the price of oil, shares of Diamondback Energy (FANG) & Occidental Petroleum (OXY) rose 14% each, and those of TechnipFMC (FTI) rose 9%.

Energy ETFs with a range of flavors gained over 6%. They include SmallCap Energy ETF (PSCE), Natural Gas ETF (FCG), Exploration & Production ETFs (PXE, XOP), and Unconventional Oil & Gas ETF (FRAK).

3. Information Technology: Fiserv (FISV) and Micron Technology (MU)

Shares of payments & financial technology provider Fiserv (FISV) rose 11% after Compass Point initiated coverage with a ‘Buy’ rating and $130 a share price target implying a 35% upside.

Micron Technology (MU) shares gained 10% after Goldman Sachs upgraded them to Buy from Neutral. The analyst upgraded shares of the semiconductor chip maker on industry checks suggesting a recovery in DRAM demand in the back half of the year.

Other top 10 winners in the S&P 500 included:

- Packaging solutions provider WestRock (WRK) up 11%

- Office REIT SL Green Realty (SLG) up 4%

- Department store Kohl’s (KSS) up 4%

Looking ahead to the week of September 21

* Federal Reserve Chairman Powell has more opportunities to press the case for additional fiscal stimulus this week. He and Treasury Secretary Mnuchin appear before the House Financial Services and the Senate Banking committees to discuss COVID19 aid.

* The S&P 500’s consumer sector heavyweights Nike (NKE), Costco Wholesale (COST), and General Mills (GIS) report their earnings.

* The economic calendar includes existing and new home sales, providing a read on the health of the housing sector. Weekly jobless claims, forecasted at 825,000, will continue to be a focal point for investors in this pandemic-centered market.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023