Concerns of the economy losing momentum in the absence of another stimulus package weighed on stock prices. Rising COVID19 case count and election uncertainties added to the worries. Bargain hunting in large-cap technology stocks could not prevent the S&P 500 from suffering its fourth straight weekly loss.

With Congress stuck in a stalemate over the next stimulus package, weaker-than-expected jobless claims and durable goods orders stoked concerns of the economic recovery losing momentum.

The rise in COVID19 case count prompted the United Kingdom to re-impose lockdown and other restrictions.

Following three straight weeks of relatively large declines in large-cap technology stocks, investors sought bargains, pushing the technology-heavy NASDAQ Composite index above the flatline for the week.

There was no such turnaround for the broader S&P 500 benchmark.

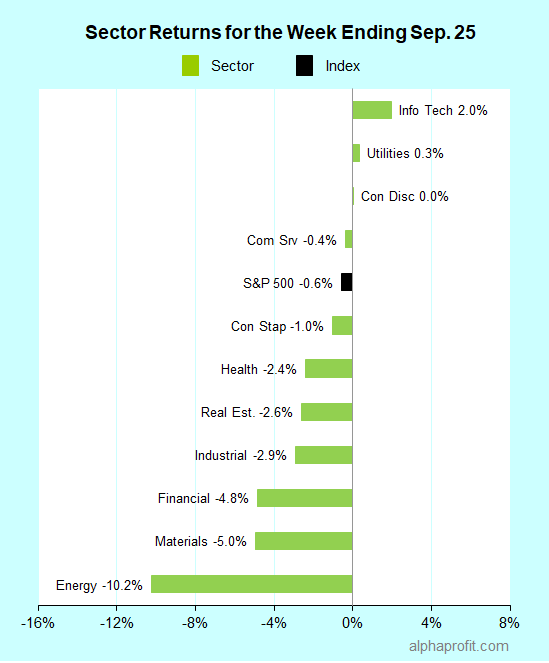

For the week ending September 25, the S&P 500 (SPY) fell 0.6%, its fourth straight weekly decline.

Three of the 11 sectors ended above the flatline.

Information technology (XLK), utilities (XLU), and consumer discretionary (XLY) led the performance chart.

Energy (XLE), materials (XLB), and financials (XLF) lost the most.

Breadth was strongly negative with the number of declining stocks in the S&P 500 beating advancers by a 3-to-1 ratio.

The S&P 500’s top 10 winners included companies from the communication services, consumer discretionary, and information technology sectors.

1. Communication Services: Twitter (TWTR)

Twitter (TWTR) shares rose 9% to be the week’s top performer. Pivotal Research Group raised the rating on the social-media platform’s shares to Buy from Hold. The new $59.75 share-price target implies a 37% upside.

2. Consumer Discretionary: Nike (NKE), Darden Restaurants (DRI), and eBay (EBAY)

Shares of Nike (NKE), Darden Restaurants (DRI), and eBay (EBAY) were up 8% each. Athletic footwear maker Nike (NKE) and the Olive Garden restaurant owner Darden (DRI) reported better-than-expected earnings. Nike saw its digital sales rise by over 80%. Darden reinstated its dividend.

eBay shares rebounded from their prior week’s decline after Piper Sandler initiated coverage with an Overweight rating and a $65 price target, implying a 27% upside.

3. Information Technology: Lam Research (LRCX) and PayPal (PYPL)

Positive comments from analysts at Citigroup and Stifel lifted shares of semiconductor equipment maker Lam Research (LRCX) to an 8% gain. PayPal (PYPL) shares gained 6% after Loop Capital initiated coverage on the digital payment company with a Buy rating.

Other top 10 winners in the S&P 500 included:

- Veterinary diagnostics equipment maker IDEXX Laboratories (IDXX) up 7%

- Tax software developer Intuit (INTU) up 6%

- Electronic trading platform MarketAxess Holdings (MKTX) up 6%

Looking ahead to the week of September 28

* The upcoming presidential election will be in focus early next week as President Trump and Democratic nominee Biden tee-off the first debate on Tuesday night.

* Key economic data are due at the back end of the week, providing insight on manufacturing, inflation, and employment. Thursday brings in reading on the Institute of Supply Management’s manufacturing index, and the personal consumption expenditures index, the Federal Reserve’s preferred inflation measure.

* The keenly watched September jobs report is due on Friday. This would be the last monthly employment report before the Presidential election. The economists’ consensus forecast is for job creation to slow to 920,000 from 1.37 million in August. The unemployment rate is expected to drop to 8.2% from 8.4%.

* Six S&P 500 members are scheduled to report earnings. Among them, investors will look to Micron Technology (MU) for providing an assessment of the state of the semiconductor chip market. Four consumer-related brands Conagra (CAG), Constellation (STZ), McCormick (MKC), and PepsiCo (PEP) report as well.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023