The Federal Reserve raised its benchmark federal funds rate by 0.5% last week and signaled interest rates would rise further next year. Investors worried that the Fed’s focus on driving inflation to its 2% long-term goal would lead to a recession. The S&P 500 fell below its 50-day moving average. The update on the Fed’s preferred inflation gauge is the highlight of this week. Housing industry data could move markets as well.

The Federal Reserve raised its federal funds benchmark interest rate by 0.5% last week to the 4.25-4.50% range, the highest in 15 years. The Fed also forecasted the rate to rise by another 0.75% by the end of 2023.

Speaking at the press conference after the Fed’s decision, Chairman Powell said recent inflation data are not enough to convince the Fed that its fight against rising prices is over.

Powell dispelled thoughts of cutting interest rates anytime soon. He said the central bank remains focused on keeping interest rate policy restrictive enough to push inflation down to its 2% goal.

The European Central Bank and the Bank of England also raised interest rates last week.

Investors feared that the Federal Reserve’s resolve to tame inflation using steep interest rate increases would lead to a recession. The Fed shared its economic projections that showed unemployment would rise and economic growth would slow in 2023.

Retail sales fell more than expected in November, adding to recession fears. Retail sales fell 0.6% compared to economists’ 0.3% estimate.

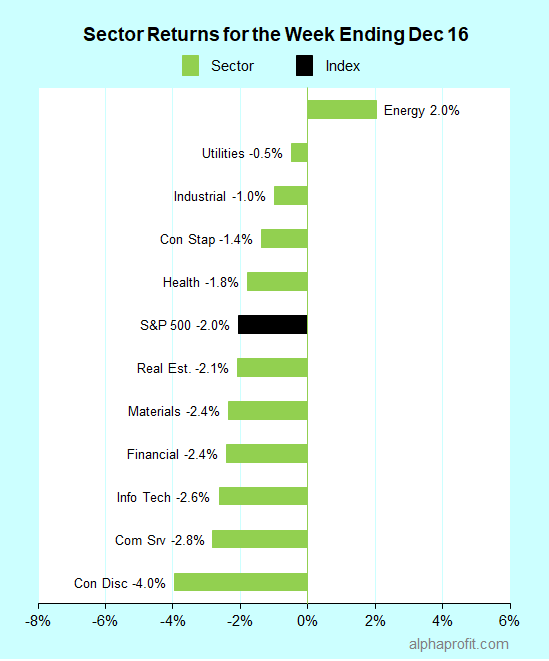

For the week ending December 16, the S&P 500 (SPY) fell 2.0%. Ten of the 11 sectors declined. Energy (XLE) was the only sector to gain, while consumer discretionary (XLY) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Moderna, (MRNA) +9% – The week’s top performer in the S&P 500.

- Universal Health Services (UHS) +7%

- Align Technology (ALGN) +5%

2. Energy Sector

- Halliburton (HAL) +9%

- Schlumberger (SLB) +5%

- Baker Hughes (BKR) +5%

- APA Corp. (APA) +5%

- EOG Resources (EOG) +5%

3. Consumer Discretionary Sector

- PulteGroup (PHM) +5%

- D.R. Horton (DHI) +5%

Top ETFs for the week

The following ETF themes worked well: energy, oil, natural gas, oil & gas exploration & production, and energy services. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) 5.6%

- United States Natural Gas Fund (UNG) 4.4%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) 3.7%

- United States Oil Fund (USO) 3.3%

- Invesco S&P 500 Equal Weight Energy ETF (RYE) 2.8%

More Selling or Santa Rally this Week?

* The S&P 500 and the NASDAQ Composite indexes fell below their 50-day moving averages late last week. Trading from the simultaneous expiration of stock options, stock index futures, and index option contracts contributed to last Friday’s decline. Traders are watching to see if stocks can attract enough buying interest for the benchmarks to rise above their 50-day moving average.

* The November update of the Personal Consumption Expenditures (PCE) Price Index from the Bureau of Economic Analysis is this week’s highlight. The PCE price index is the Federal Reserve’s preferred inflation measure. TradingEconomics.com forecasts the PCE to increase by 0.3% in November, matching October’s tally. Economists expect the PCE to continue falling on a year-over-year basis. TradingEconomics.com projects the annual change in the PCE to decline to 5.5% in November from 6.0% in October.

* Data on the state of the U.S. housing market are due. The reports include November housing starts, building permits, sales of new homes, and sales of existing homes.

* CarMax, FedEx, General Mills, Micron Technology, and Nike are among the S&P 500 member companies reporting earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023