U. S. stocks rose for a second straight week. Investors focused on comments from Fed Chairman Powell and developments in the Russia-Ukraine war. Bond yields surged while oil prices rose; the latter helped energy stocks lead the market. The 10-year Treasury yield surged to its highest level since May 2019.

Federal Reserve Chair Powell promised to take a tough stand against inflation and hinted at aggressive interest rate increases. Investors adjusted their expectations for the Fed to raise interest rates by 0.5% after its interest rate policy meetings in both May and June. The yield on the 10-year Treasury note jumped nearly 0.35% to 2.49%, the highest since May 2019.

U. S. oil prices surged 9% on the back of the Russia-Ukraine crisis and tensions in the Middle East. West Texas Intermediate crude closed the week at $113.90 per barrel.

NATO leaders met in Brussels to discuss increasing pressure on Russia. They agreed to increase military aid to Ukraine and tighten sanctions on Russia.

U. S. economic data reflected the strain of rising interest rates on home mortgages and high inflation. The National Association of Realtors said pending home sales fell 4.1% in February to their lowest since June 2020. The University of Michigan’s final consumer sentiment reading fell slightly in March to stay near an 11-year low.

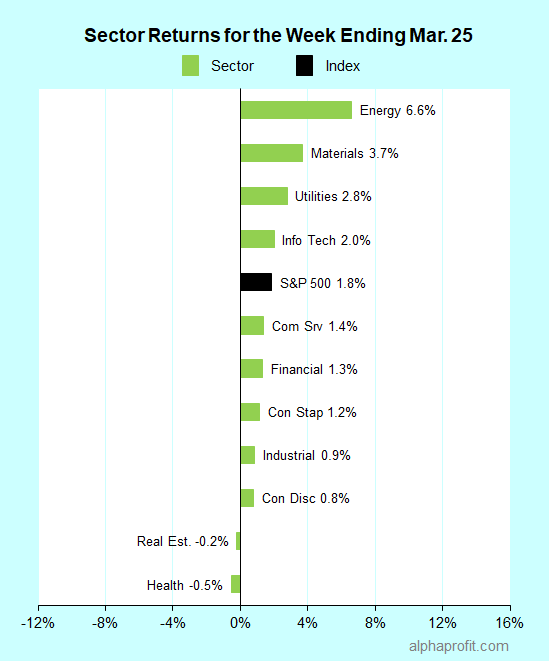

Stocks in commodity-oriented sectors prospered the most.

For the week ending March 25, the S&P 500 (SPY) rose 1.8%. Nine of the 11 sectors advanced.

Leading and lagging sectors as inflation, bond yields, and oil prices impact stocks – March 25, 2022.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 3-to-2 ratio.

Energy (XLE), materials (XLB), and utilities (XLU) led the S&P 500, gaining 2.8% or more.

Health care (XLV), real estate (XLRE), and consumer discretionary (XLY) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Energy

Energy stocks fared well amidst the backdrop of higher oil prices. Oil rose on speculation of the European Union following the U. S. in blocking imports of Russian energy. Yemen’s Iran-backed Houthi rebels destroyed a Saudi Aramco oil facility in Jeddah with a missile strike, threatening supplies.

Coterra Energy (CTRA) +16% – Amidst the positive backdrop for energy stocks, Coterra Energy (CTRA) rose 16% to be the week’s top performer in the S&P 500. The added boost came after the U. S. and Europe agreed to a deal in principle to ensure Europe gets a steady stream of U. S. liquefied natural gas to help replace Russian gas.

The top 10 winners of the S&P 500 also included four more energy companies in Marathon Oil (MRO), Hess Corp. (HES), Diamondback Energy (FANG), and Schlumberger (SLB), each of which gained 10-13%.

2. Materials

Nucor Corp. (NUE) +16% – The steel maker gained after stating that it expects to report record earnings in the first quarter with EPS more than doubling to exceed $7.20 a share.

CF Industries (CF) +15% and The Mosaic Co. (MOS) +15% – The fertilizer producers rallied as analysts raised EPS forecasts for CF Industries and Mosaic on improving prospects for fertilizer prices to stay high through 2022.

3. Consumer Discretionary

Tesla (TSLA) +12% – The electric vehicle maker opened its long-awaited Gigafactory near Berlin, Germany, enhancing its position to deliver cars for the large European auto market. Tesla expects the plant to produce 500,000 vehicles annually when fully functional.

4. Consumer Staples

Archer-Daniels-Midland (ADM) +11% – The food processor and transporter soared as grain prices continued to spiral higher. Russia’s invasion of Ukraine threatens grain supplies from the breadbasket of Europe.

Top ETFs for the week

The following ETFs themes worked well: cannabis, oil & gas, oil services, Brazil, and metals & mining. The top ETFs for the week include:

- ETFMG Alternative Harvest ETF (MJ) +15.2%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +10.7%

- VanEck Oil Services ETF (OIH) +9.0%

- iShares MSCI Brazil ETF (EWZ) +8.8%

- SPDR S&P Metals and Mining ETF (XME) +8.1%

Top Fidelity Fund for the week

- Fidelity Select Energy (FSENX) +8.5%

Three Factors to Watch: Inflation, Yields, and Oil

The economic calendar this week is a busy one. The focal points include the March jobs report and a read on the Fed’s preferred inflation measure. Bond yields, oil prices, and developments in the war in Ukraine are likely to add to volatility.

* Investors will look to assess if the March job report and inflation data will encourage the Federal Reserve to raise interest rates by 0.5% when the central bank discusses interest rate policy in early May. Economists expect the Labor Department’s report to show the addition of 460,000 jobs in March, compared to 678,000 in February. They expect the unemployment rate to decline to 3.7% from 3.8% in February. As for inflation, economists expect the core personal consumption expenditures index to rise by 5.5% for the 12 months ending in February, up from 5.2% in January.

* Investors are watching the yield of the 10-year Treasury note to see if it can consolidate around 2.5% after surging last week. The U. S. Treasury’s auctions $151 billion in two-, five- and seven-year notes. The auction’s bid-to-cover ratio should provide insights on demand for bonds amidst high inflation. A low bid-to-cover ratio could spell more trouble for bonds.

* Oil is a wild card. It retraced part of its prior pullback last week. A continuing rise in oil towards its previous 2022 high of $130 per barrel is likely to be troublesome for stocks.

* The situation in Ukraine remains fluid, with talks between Russia and Ukraine not proving fruitful so far. While investors expect a resolution in the conflict, the path towards one remains unclear.

* The earnings reporting cycle is at its slow point. Investors will look to comments from Micron Technology for insights into the impact of the Ukraine war on the semiconductor industry. McCormick, Paychex, and Walgreens Boots Alliance report earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023