Last week, the S&P 500 gained 1.6% after swinging wildly in both directions. Investors tried to predict the impact of the economic data on Fed policy. Weakness in factory activity and fewer job openings spurred stocks to rally. The gains shrunk after the September jobs report. Wall Street awaits a big week that marks the start of the third quarter earnings reporting season. The economic calendar includes data on inflation and minutes from the Fed’s last interest rate policy meeting.

The S&P 500 swung by nearly 3%, up and down, on three of the five days last week as investors tried to assess the impact of economic data on interest rates.

Stocks started the week of October 3 with a bang as bond yields tumbled in response to weaker-than-expected manufacturing data and fewer job openings.

The Institute for Supply Management (ISM) reported that its manufacturing index fell to 50.9 in September, its lowest since May 2020. Economists surveyed by Dow Jones expected a reading of 52.0.

The Bureau of Labor Statistics reported a decline of over 1 million job openings in August to 10.1 million. The tally trailed FactSet’s estimate by 1 million.

A sizeable part of the gains in stock price reversed later in the week as comments from Federal Reserve officials and economic data raised interest rate worries.

The Presidents of Chicago, New York, and San Francisco Federal Reserve said inflation is troublesome. They insisted that the central bank would continue to raise interest rates to combat inflation.

Further, the ISM reported that its services index declined by a modest 0.2% in September to 56.7 after its employment component rose by 2.8%. Economists had expected the index to fall by 1.0% to 56.0.

The S&P 500 dropped 2.8% after the Labor Department released the September jobs report on Friday. The report showed the U.S. economy added 263,000 jobs in September, slightly below consensus economists’ estimate of 275,000. Yet, the unemployment rate fell to 3.5% from 3.7% in August. Average hourly earnings rose 0.3%.

Investors surmised Fed officials would raise interest rates aggressively to combat the support inflation is getting from continued growth in the number of jobs and wages.

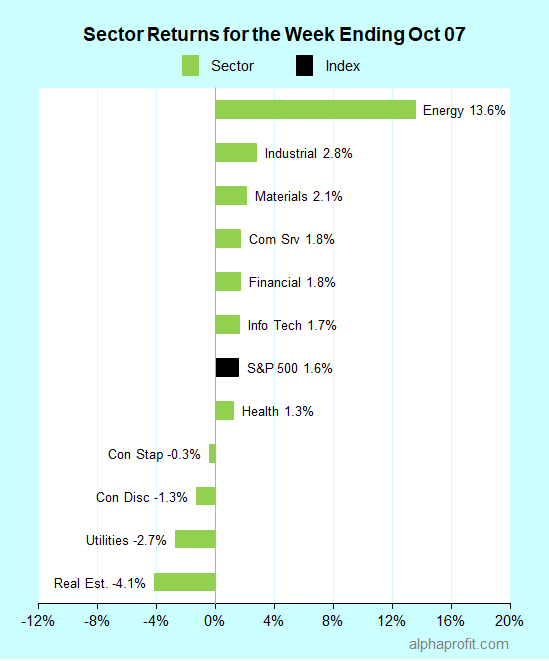

For the week ending October 07, the S&P 500 (SPY) rose 1.6%. Seven of the 11 sectors gained.

Energy (XLE) gained the most, while real estate (XLRE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- DexCom (DXC) +27% – The week’s top performer in the S&P 500.

2. Energy Sector

- APA Corp. (APA) +24%

- Marathon Oil (MRO) +24%

- Halliburton (HAL) +24%

- Devon Energy (DVN) +20%

- Schlumberger (SLB) +19%

- Pioneer Natural Resources (PXD) +19%

- Diamondback Energy (FANG) +18%

- Hess Corp. (HES) +18%

3. Consumer Discretionary Sector

- Wynn Resorts (WYNN) +16%

Top ETFs for the week

The following ETF themes worked well: energy in various flavors including oil services, oil & gas exploration, oil, and natural gas. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) 17.1%

- United States Oil Fund, LP (USO) 15.0%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) 14.3%

- First Trust Natural Gas ETF (FCG) 13.6%

- Energy Select Sector SPDR Fund (XLE) 13.6%

Wall Street Awaits a Big Week Starting on October 10

* The third quarter earnings reporting season kicks off this week. Investors will focus on the earnings reports from the financial sector as several big names, including JPMorgan Chase, Morgan Stanley, BlackRock, and Citigroup, report this week. According to FactSet, analysts expect financial sector earnings to fall 13.5% this quarter. PepsiCo, Taiwan Semiconductor, Delta Air Lines, and UnitedHealth report outside the financial sector.

* Investors will have plenty of items to ponder about the state of the economy. Data on inflation & retail sales and the minutes from the Federal Reserve’s September 20-21 interest rate policy meeting are due. According to TradingEconomics.com, economists expect the consumer price index (CPI) to rise 0.2% in September, compared with a gain of 0.1% in August. They expect the increase in the CPI to moderate to 8.1% in September, from 8.3% in August. Economists expect core CPI inflation, which excludes food and energy prices, to show a 6.5% annual increase in September, up from 6.3% in August.

* A new wave of COVID cases appears to be gaining traction in Europe, where infections and hospitalizations are up. Two Omicron subvariants account for most of the new cases, while newer subvariants are gaining ground. With European economies already battered by the energy crisis, a further rise in COVID cases can become another cause of concern as colder weather moves in.

* The week is shaping up to be a big one for crypto finance. The G20 nations meet in Washington on Wednesday and Thursday. G20’s Financial Stability Board (FSB) will set out plans for regulating crypto markets and decentralized financial industries at this meeting. The regulations could make it harder for cryptocurrencies to expand their services without complying with regulations.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023