U.S. stocks extended their gains after the Fed raised interest rates by 0.25%, as expected, and Chair Powell said the disinflationary process has started. The job market continued to exhibit vigor, while earnings from Alphabet, Amazon, and Apple disappointed investors. Investors will scrutinize earnings reports from about 90 S&P 500 members this week.

Last Wednesday, the Federal Reserve’s interest rate policy committee raised the benchmark federal funds interest rate by 0.25% to the 4.50-4.75% range. Market participants widely anticipated this outcome.

Comments from Chairman Jerome Powell on disinflation came as a relief to investors. Powell said, “We can now say for the first time that the disinflationary process has started.”

The Fed did not provide a timeline on when it may pause interest rate increases. The central bank said ongoing increases in interest rates would be needed to return inflation to its 2.0% long-term goal over time.

The European Central Bank and the Bank of England followed the Fed, raising their benchmark interest rates by 0.5%, in line with economists’ expectations.

Data from the job market continued to be a bastion of strength. The U.S. economy added 517,000 jobs in January, well above economists’ forecast of 187,000. The unemployment rate fell to 3.4%, its lowest since 1969. Average hourly earnings rose 0.3%, in line with expectations. Additionally, job openings surged in December to 11.0 million from 10.4 million in November.

In other economic reports, the Institute for Supply Management’s (ISM) manufacturing index declined more than economists expected to 47.4 in January from 48.4 in December. The ISM’s services activity index rebounded sharply to 55.2 in January from 49.6 in December. Economists had forecasted 50.6.

Marquee companies reported mixed earnings. Facebook-parent Meta Platforms fared well, while Alphabet, Amazon, and Apple fell short of analysts’ expectations.

Enduring strength in stock prices pushed the S&P 500’s 50-day moving average above its 200-day moving average last Thursday, forming a “golden cross.” Chart analysts see the golden cross as a bullish signal.

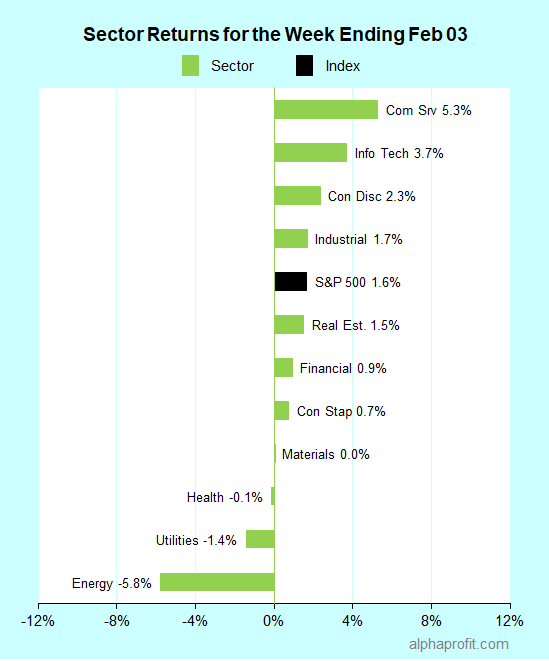

For the week ending February 03, the S&P 500 (SPY) rose 1.6%. Eight of the 11 sectors advanced. Communication services (XLC) gained the most, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Healthcare Sector

- Align Technology, (ALGN) +27% – The week’s top performer in the S&P 500.

- Stryker Corp. (SYK) +11%

2. Communication Services Sector

- Meta Platforms (META) +23%

3. Industrial Sector

- W.W. Grainger (GWW) +18%

- Pentair PLC (PNR) +15%

- A. O. Smith Corp. (AOS) +14%

- FedEx Corp. (FDX) +13%

4. Information Technology Sector

- Advanced Micro Devices (AMD) +14%

5. Consumer Discretionary Sector

- CarMax (KMX) +13%

- PulteGroup (PHM) +12%

Top ETFs for the week

The following ETF themes worked well: smallcaps, banking, innovation, homebuilders, and transportation. The top ETFs for the week include:

- Invesco S&P SmallCap 600 Revenue ETF (RWJ) 6.2%

- SPDR S&P Regional Banking ETF (KRE) 6.2%

- ARK Innovation ETF (ARKK) 6.1%

- SPDR S&P Homebuilders ETF (XHB) 6.0%

- iShares Transportation Average ETF (IYT) 5.9%

What’s Next after the Golden Cross

* Investors will look for the rally in stocks to continue after the S&P 500 index successfully formed a “golden cross” last week.

* Corporate earnings will be in the spotlight this week. Nearly 90 of the S&P 500 index members report earnings. AbbVie, CVS Health, Disney, Linde PLC, PayPal Holdings, PepsiCo, and S&P Global are some of the widely followed names on this week’s earnings calendar.

* The University of Michigan releases its preliminary January consumer sentiment reading along with inflation expectations on Friday. Economists surveyed by Dow Jones expect consumer sentiment to rise and inflation expectations to fall.

* Jobless claims numbers are likely to get more scrutiny than they usually do. Investors will likely seek confirmation of the labor market’s robustness in the jobless claims data after job creation in January topped economists’ forecasts by a wide margin last Friday.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023