Risk-on trades flourished in the early part of the week. Several states announced plans to ease restrictions imposed to stem the spread of the coronavirus. Gilead Sciences’ (GILD) remdesivir offered hope of becoming an approved cure for COVID-19. This rally, however, started to unravel by the end of the week.

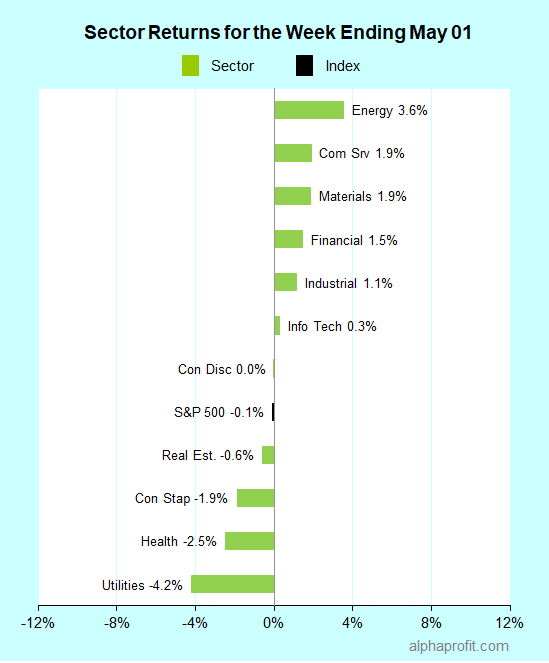

For the week ending 5/1, the S&P 500 (SPY) lost 0.1%.

Energy (XLE), communication services (XLC), and materials (XLB) outperformed the S&P 500. Defensive sectors utilities (XLU) and health care (XLV) declined.

The S&P 500’s top winners list included:

Beaten-down cruise operators and REITs managing to hold on to gains from the ‘risk-on’ phase

Norwegian Cruise Line (NCLH) +27%, Kimco Realty (KIM) +23%, Simon Property Group (SPG) +23%, and Carnival Corp. (CCL) +17%

Companies reporting better-than-expected earnings

O-I Glass (OI) +27%, Fortune Brands Home & Security (FBHS) +18% and Principal Financial Group (PFG) +17%

Troubled buyout targets with offers in limbo

Delphi Technologies (DLPH) +20% and L Brands (LB) +16%

AlphaProfit’s Recommendations of Best Growth Stocks to Buy Now

AlphaProfit recommends attractively valued stocks with favorable near-term prospects in each Premium Service Monthly Report to help you profit from short-term investment opportunities.

To provide you with reliable winning stock recommendations, AlphaProfit evaluates stocks on both fundamental and technical factors.

Fundamental analysis ensures recommended companies are worthy of committing your precious dollars from quality, valuation, and growth perspectives.

Technical analysis provides precise buy & sell price recommendations to lock your gains.

The proof of AlphaProfit’s methodology is in the results (registration required).

On average, subscribers have netted a 12.8% gain in 2.6 months from each stock recommendation at a 91% win rate.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023