Economic data and comments from Federal Reserve officials intensified investors’ recession fears. Inflation exceeded expectations while the job market showed no sign of wilting. Fed officials reiterated their commitment to containing inflation, even at the expense of the economy. The economy and the Fed remain in focus this week. The Labor Department reports on job creation in September on Friday. Speeches from Fed officials could also move stock prices.

Investors became increasingly concerned that the Federal Reserve will aggressively raise interest rates in the coming months to combat inflation.

The personal consumption expenditure (PCE) price index, the Federal Reserve’s preferred inflation measure, showed that core consumer prices climbed by 0.6% in August, exceeding economists’ 0.5% forecast. The core PCE rose 4.9% year-over-year, higher than economists’ 4.7% forecast.

Jobless claims for the week ending September 24 exceeded consensus economists’ forecast. The Labor Department’s report showed initial claims for unemployment benefits fell by 16,000 to 193,000, the lowest since late April.

Investors also digested comments from several Federal Reserve officials who reiterated that the central bank would keep interest rates elevated to combat inflation and warned against prematurely easing interest rates.

The S&P Case-Shiller home price index provided some calm in an otherwise dismal week. The CSI showed higher interest rates are cooling the housing market. Prices across the nation fell at the fastest rate in the index’s history from June to July.

Meanwhile, inflation in the Eurozone set a new record high of 10% in September. The British currency fell to an all-time low against the dollar. The Bank of England said it would temporarily purchase long-dated UK government bonds in an effort to stabilize its plunging currency.

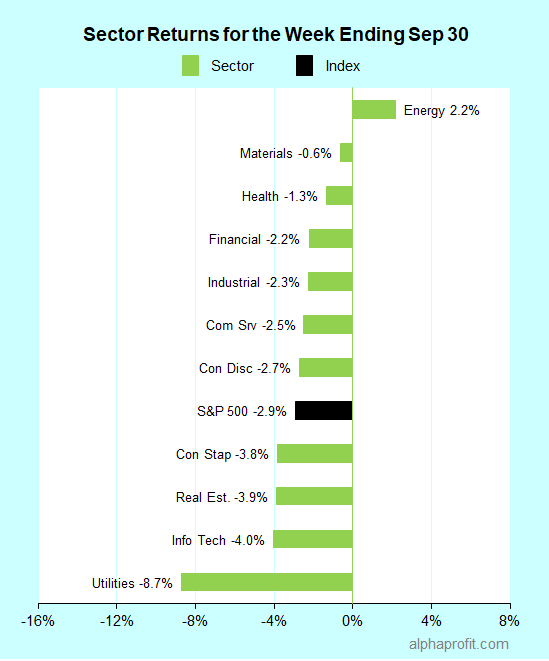

For the week ending September 30, the S&P 500 (SPY) fell 2.9%. Ten of the 11 sectors declined.

Energy (XLE) was the only sector to gain, while utilities (XLU) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Biogen (BIIB) +35% – The week’s top performer in the S&P 500.

- Charles River Laboratories (CRL) +5%

2. Energy Sector

- Marathon Petroleum (MPC) +9%

- Valero Energy (VLO) +6%

- Phillips 66 (PSX) +6%

- Occidental Petroleum (OXY) +5%

- Diamondback Energy (FANG) +5%

3. Consumer Discretionary Sector

- Las Vegas Sands (LVS) +6%

- Wynn Resorts (WYNN) +6%

4. Communication Services Sector

- Twitter (TWTR) +5%

Top ETFs for the week

The following ETF themes worked well: precious metals, gold, silver, oil & gas, uranium, and biotechnology. The top ETFs for the week include:

- ETFMG Prime Junior Silver Miners ETF (SILJ) 9.6%

- VanEck Junior Gold Miners ETF (GDXJ) 9.1%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) 5.2%

- Sprott Uranium Miners ETF (URNM) 3.9%

- SPDR S&P Biotech ETF (XBI) 3.5%

Where are Stocks Headed after Falling 9% in September?

* The start of a new month brings fresh economic data, spearheaded by the September jobs report. The Labor Department’s report on Friday should show how well the labor market is holding up in the face of three 0.75% step-ups in benchmark interest rates. Economists surveyed by Dow Jones expect the economy to add 275,000 nonfarm jobs in September, down from August’s 315,000. They expect the unemployment rate to remain unchanged at 3.7%. Economists also expect modest declines in manufacturing and service activity measures from the Institute of Supply Management.

* The Federal Reserve Bank of Cleveland’s President, Mester, a member of the interest rate-setting Federal Open Market Committee, speaks on Tuesday and Thursday next week.

* A handful of consumer staples companies in the S&P 500 index report earnings. They include Conagra, Constellation Brands, Lamb Weston, and McCormick.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023