U.S. stocks fell to post their first loss of the year as investors worried about a recession. The deterioration in measures of manufacturing and retailing activities exceeded economists’ expectations. The earnings reporting season gathers steam this week. Investors will receive updates on growth and inflation measures.

Last week, economic growth indicators raised the specter of a recession. The New York Fed’s Empire State Manufacturing Survey fell sharply in January, suggesting a contraction in manufacturing. Orders fell, while employment growth stalled.

Separately, retail sales dropped 1.1% in December as consumer spending slowed. The decline in retail sales exceeded economists’ 1.0% forecast.

The mixed quality of fourth-quarter earnings reports offered little to alleviate recession worries. Investors bid up the shares of Morgan Stanley and Netflix after the companies reported earnings. Conversely, shares of Charles Schwab, Goldman Sachs, and Procter & Gamble fell.

The labor market, however, continued to remain vibrant, showing no signs of slowing. Weekly jobless claims fell, pointing towards continued tightness.

Inflation data comforted investors. The producer price index declined 0.5% in December, well above economists’ forecast for a decline of 0.1%. Price measures in the New York Fed’s Manufacturing Survey indexes fell.

Although inflation continued to moderate, Federal Reserve officials did not signal an intent to halt interest rate increases. Instead, they appeared inclined to slow the pace of interest rate increases. Investors fretted that a tight job market would encourage the Fed to raise interest rates more than needed.

The U.S. hit its $31.4 trillion debt ceiling last Thursday. The Treasury Department began to use a series of “extraordinary measures” to avoid a government debt default. These measures give the U.S. until June to either raise the debt ceiling, suspend the debt ceiling, or figure another way out.

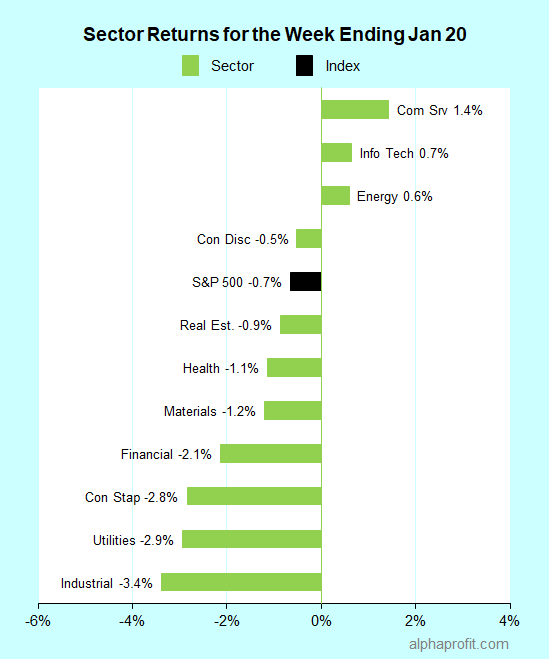

For the week ending January 20, the S&P 500 (SPY) fell 0.7%. Three of the 11 sectors advanced. Communication Services (XLC) gained the most, while industrials (XLI) lost the most.

The S&P 500’s top 10 winners included the following:

1. Financial Sector

- SVB Financial Group, (SIVB) +15% – The week’s top performer in the S&P 500.

- Signature Bank (SBNY) +9%

- First Republic Bank (FRC) +7%

2. Health Care Sector

- ResMed (RMD) +10%

3. Communication Services Sector

- Match Group (MTCH) +9%

- Alphabet (GOOG) +8%

4. Information Technology Sector

- NVIDIA Corp. (NVDA) +8%

- ServiceNow (NOW) +7%

5. Consumer Discretionary Sector

- Expedia Group (EXPE) +8%

- Tesla (TSLA) +8%

Top ETFs for the week

The following ETF themes worked well: bitcoin, carbon credits, Indonesia, Japan, and fintech. The top ETFs for the week include:

- ProShares Bitcoin Strategy ETF (BITO) 14.6%

- KraneShares Global Carbon ETF (KRBN) 4.2%

- iShares MSCI Indonesia ETF (EIDO) 3.6%

- WisdomTree Japan Hedged Equity Fund (DXJ) 3.1%

- ARK Fintech Innovation ETF (ARKF) 3.0%

Will 4Q2022 Earnings Pull Stocks Out of Malaise?

* Stocks are stuck in a trading range. The S&P 500 has ranged between 3,750 and 4,100 since the start of 2023. Stock prices have fluctuated as investor confidence in the Federal Reserve’s ability to lower inflation without causing a recession has waxed and waned.

* A busy week lies ahead on the earnings front. Over 100 members of the S&P 500 index, including six of the 20 top constituents, report quarterly earnings. They are Chevron, Johnson & Johnson, Mastercard, Microsoft, Tesla, and Visa.

* The Bureau of Economic Analysis (BEA) will release the Personal Consumption Expenditures (PCE) Price Index for December on Friday. Economists surveyed by Dow Jones expect inflation to continue trending lower. They expect the core PCE price index, which excludes food and energy costs, to rise 4.4% year-over-year in December, down from 4.7% in November.

* The BEA will also release its preliminary gross domestic product growth estimate for the final quarter of 2022. Economists surveyed by Dow Jones expect the pace of expansion to slow to a seasonally adjusted annual rate of 2.8% from 3.2% in the third quarter.

* The debt ceiling has been pushed into the background for now. House Republicans want to cut government programs before they approve a higher ceiling. So far, the White House has refused to negotiate with hardline Republicans, believing the latter would eventually back off their demands due to pressure from conservative & moderate Republicans and business groups. However, the risk of a decline in stock prices would rise if the debt ceiling remained unresolved until the last minute in June.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023