U.S. stocks reversed the rally spurred by inflation data. Fed officials dispelled hopes that the central bank would moderate interest rate increases. Worries of a recession also increased, as reflected by a steeping yield curve. Trading this week is a three-and-a-half-day affair on account of the Thanksgiving holiday. Shopping activity on Black Friday will be in focus on the heels of mixed third-quarter earnings reports from retailers. Minutes from the November Fed meeting can also move markets.

Last week, stocks tried to build on the momentum from the prior week’s broad rally spurred by a lower-than-expected increase in the consumer price index. The producer price index data helped the cause as the 0.2% increase in October lagged economists’ 0.4% forecast.

Walmart’s earnings report also lifted stock prices after the retailer beat analysts’ third-quarter sales and EPS estimates and boosted full-year guidance.

The rally, however, lost steam after Federal Reserve officials pressed the case for higher interest rates. St. Louis Fed President Bullard said interest rate increases have so far “had only limited effects on observed inflation.” Boston Fed President Collins said there is little evidence that “price pressures are waning.”

Investors’ recession concerns also rose, as evidenced by the steepening inversion in the yield curve. The yield on the 2-year Treasury note rose by 0.18% to 4.51%, while the 10-year Treasury note yield rose 0.01% to 3.82%. The 0.69% yield difference marked the deepest inversion in over 40 years.

Target added to recession fears by forecasting a drop in holiday quarter sales. The retailer cited the impact of inflation on consumer spending. The Conference Board’s U.S. leading economic index fell for the eighth straight month in October. Existing-home sales fell for the ninth consecutive month in October.

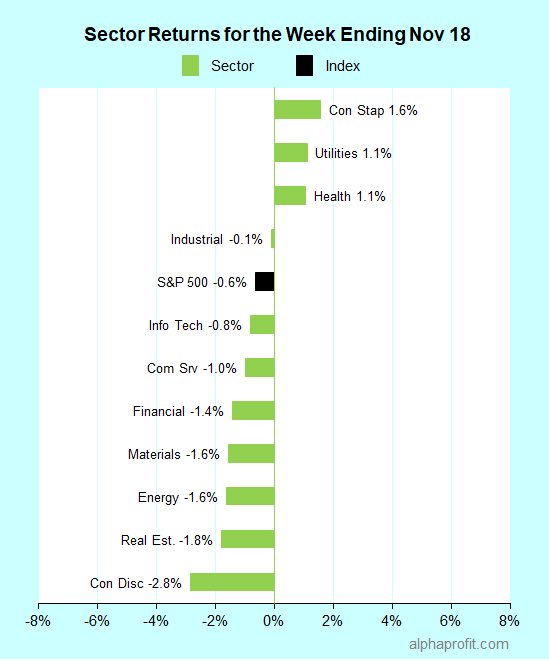

For the week ending November 18, the S&P 500 (SPY) fell 0.6%. Three of the 11 sectors advanced.

Consumer staples (XLP) gained the most, while consumer discretionary (XLY) lost the most.

The S&P 500’s top 10 winners included the following:

1. Consumer Discretionary Sector

- Ross Stores (ROST) +12% – The week’s top performer in the S&P 500.

- Bath & Body Works (BBWI) +6%

2. Information Technology Sector

- Jack Henry & Associates (JKHY) +7%

- Enphase Energy (ENPH) +7%

- Cisco Systems (CSCO) +7%

- SolarEdge Technologies (SEDG) +6%

3. Financial Sector

- Lincoln National (LNC) +7%

4. Health Care Sector

- Merck & Co. (MRK) +6%

- Moderna (MRNA) +6%

- AmerisourceBergen (ABC) +6%

Top ETFs for the week

The following ETF themes worked well: China, natural gas, bitcoin, and long duration bonds. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) 7.6%

- United States Natural Gas Fund (UNG) 7.3%

- ProShares Bitcoin Strategy ETF (BITO) 3.7%

- PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ) 3.1%

- iShares MSCI China ETF (MCHI) 2.8%

Will Black Friday Push the S&P 500 Over its 200DMA?

* Investors have their eyes on the S&P 500 and its 200-day moving average after the index approached this trendline last week only to turn away. Investors will watch to see if the benchmark can gain enough momentum to surpass its 200-day moving average during this short trading week.

* Black Friday kicks off the holiday shopping season this week amid stubborn inflation. Consumers are contending with rising interest rates, while retailers are coping with supply-chain disruptions and excess inventories. Third-quarter earnings reports from retailers indicate a growing performance gap between the big box and specialty retailers. Black Friday shopping reports can move markets as they set expectations for consumer spending and retailer performance.

* The Federal Reserve will release the minutes from its November interest rate policy meeting. The transcript could provide insights into the Fed’s interest rate plan. The University of Michigan will publish data on inflation expectations in its November Consumer Sentiment report. The Fed transcript and the update on inflation expectations have the potential to move the market.

* A handful of S&P 500 member companies, including Deere & Company, Medtronic, Analog Devices, Autodesk, Agilent Technologies, and Dollar Tree, are due to report earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023