Better-than-expected earnings reports and hopes that the Federal Reserve could slow the pace of interest rate increases helped stocks overcome headwinds from surging bond yields and close last week with robust gains. Bond yields and mega-cap tech company earnings could determine if stock prices extend the rally to this week. An update to the Federal Reserve’s preferred inflation gauge is also due.

The S&P 500 managed to hold onto more than 2% gains made on Monday and Friday, finishing the week up 4.7%.

Bank of America reported stronger-than-expected third-quarter earnings, powering the advance on Monday. Hopes of the Federal Reserve slowing the pace of interest rate increases after November spurred the rally on Friday.

According to FactSet, 72% of the hundred S&P 500 companies reporting third-quarter earnings have exceeded analysts’ forecasts. Goldman Sachs, Netflix, and Schlumberger were among those that stood out.

Concerns about the Federal Reserve aggressively raising interest rates pushed the 10-year Treasury note yield to its highest level since 2008. The 10-year yield surged to 4.33% before pulling back to close the week at 4.21%.

The Treasury bond yield fell on Friday after the Wall Street Journal reported that some Fed officials would want to talk about slowing the pace of interest rate hikes after raising them by 0.75% at their November meeting.

Supporting this sentiment, San Francisco Fed President Daly said the Federal Reserve could begin to back off slightly from its aggressive pace of interest-rate hikes late this year.

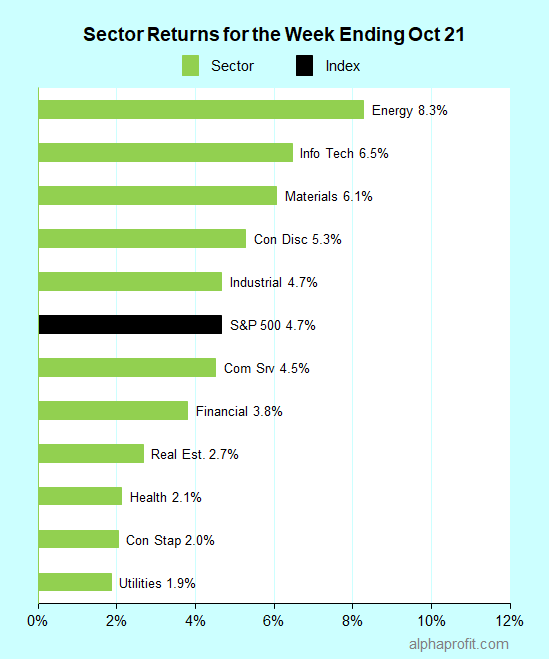

For the week ending October 21, the S&P 500 (SPY) rose 4.7%. All of the 11 sectors advanced.

Energy (XLE) gained the most, while utilities (XLU) gained the least.

The S&P 500’s top 10 winners included the following:

1. Communication Services Sector

- Netflix (NFLX) +26% – The week’s top performer in the S&P 500.

2. Energy Sector

- Schlumberger (SLB) +20%

- Baker Hughes (BKR) +16%

- Halliburton (HAL) +15%

3. Health Care Sector

- Intuitive Surgical (ISRG) +19%

4. Information Technology Sector

- Lam Research (LRCX) +17%

5. Industrial Sector

- Lockheed Martin (LMT) +17%

6. Materials Sector

- Freeport-McMoRan (FCX) +16%

7. Consumer Discretionary Sector

- Carnival Corp. (CCL) +15%

- Norwegian Cruise Line Holdings (NCLH) +15%

Top ETFs for the week

The following ETF themes worked well: oil services, Brazil, rare earth, metals, aerospace, defense, and Latin America. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) 15.5%

- iShares MSCI Brazil ETF (EWZ) 11.4%

- VanEck Rare Earth/Strategic Metals ETF (REMX) 10.2%

- iShares U.S. Aerospace & Defense ETF (ITA) 9.5%

- iShares Latin America 40 ETF (ILF) 9.3%

Will Bonds and Mega-cap Techs Help Sustain the Rally?

* The 10-year Treasury yield declined on Friday after gaining 0.30% from its October 14 close of 4.01%. This reversal has given hope that bond yields may have topped, albeit temporarily. A resumption of the increase in bond yields this week could derail the stock price rally that started last week.

* Earnings reports from the four biggest U.S. companies by market capitalization are due this week. Alphabet and Microsoft report on Tuesday, and Amazon and Apple report on Thursday. The four companies account for 20% of the S&P 500. The earnings reports should provide investors with information on how companies with dominant positions are coping against macroeconomic headwinds. They will provide investors with insight into the state of cloud computing, online advertising, consumer spending, and personal computing.

* Leading companies outside the technology sector that report this week include Boeing, McDonald’s, Caterpillar, Merck, and ExxonMobil.

* The September reading of the personal expenditures index is the eagerly awaited economic data for the week. Economists surveyed by Dow Jones expect the monthly rise in core inflation, which excludes food and energy prices, to moderate to 0.4% in September from 0.6% in August. They forecast core inflation to rise by a 5.2% annual rate during the 12 months that ended in September, up from 4.9% in August.

* The Bureau of Economic Analysis (BEA) releases its advance estimate for third-quarter U.S. GDP growth on Thursday. Economists surveyed by Dow Jones expect the U.S. economy to grow at an annualized rate of 2.4%, marking its first quarter of growth in 2022.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023