Stocks snapped their two-week rally. Rising Treasury bond yields and subpar earnings pressured stocks amid calls for higher interest rates from Fed officials. Investors await the January consumer price index report this week. Earnings reports from about 60 S&P 500 members are due.

Following the previous Friday’s surprisingly strong January jobs report, several Federal Reserve officials voiced their support for higher interest rates. They said additional interest rate hikes were needed to control inflation.

Speaking to the Economic Club of Washington, Fed Chair Jerome Powell said, “The disinflationary process, the process of getting inflation down, has begun, and it’s begun in the goods sector.” Powell cautioned that we are in the early stages of disinflation and have a long way to go.

Referring to the January jobs report, Powell said, “We didn’t expect it to be this strong.” He said the jobs data show why the disinflation process will take quite some time.

The Treasury security auction saw tepid demand from investors in the wake of concerns over rising interest rates. Yields on the 10-year Treasury note surged by 0.22% to 3.74%, their highest in more than a month.

The fourth-quarter earnings reporting season moved forward. By the end of the week, nearly 70% of the S&P 500 companies had reported earnings, giving investors a relatively complete picture.

Analysts labeled the fourth quarter earnings reporting season “underwhelming.” Only 70% of the S&P 500 members reporting earnings have topped analysts’ forecasts. In comparison, 77% and 73% of the index members have exceeded earnings forecasts over the past 5 and 10 years, respectively.

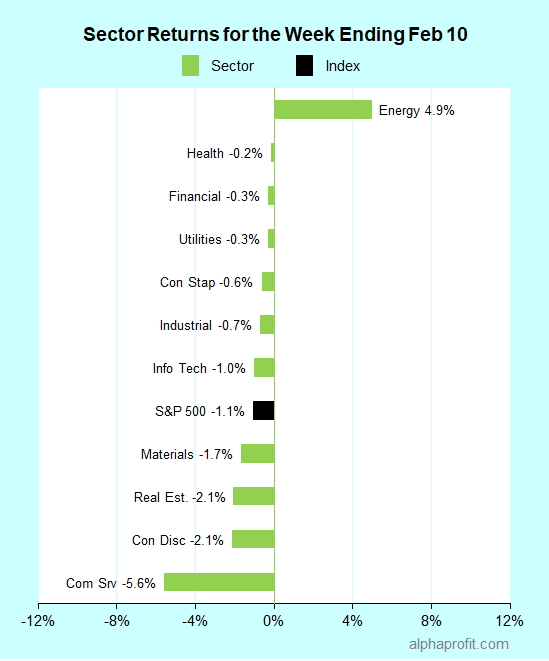

For the week ending February 10, the S&P 500 (SPY) fell 1.1%. Ten of the 11 sectors declined, with energy being the only gainer. Communication services (XLC) lost the most.

The S&P 500’s top 10 winners included the following:

1. Healthcare Sector

- Catalent, (CTLT) +26% – The week’s top performer in the S&P 500.

- DexCom (DXCM) +9%

2. Information Technology Sector

- Fortinet FTNT 12%

- Fiserv FISV 8%

- Monolithic Power Systems MPWR 8%

3. Financial Sector

- Everest Re Group RE 11%

- Cincinnati Financial CINF 9%

4. Energy Sector

- Phillips 66 PSX 9%

- Diamondback Energy FANG 8%

- EOG Resources EOG 8%

Top ETFs for the week

The following ETF themes worked well: energy including oil, natural gas, oil & gas exploration & production, and integrated oil. The top ETFs for the week include:

- United States Oil Fund, LP (USO) 8.5%

- United States Natural Gas Fund, LP (UNG) 7.3%

- iShares U.S. Oil & Gas Exploration & Production ETF (IEO) 5.5%

- iShares Global Energy ETF (IXC) 5.3%

- Energy Select Sector SPDR Fund (XLE) 4.9%

Will CPI Pressure Stocks Further?

* The update on inflation at the retail level is the main event of the week. The Bureau of Labor Statistics will publish the January Consumer Price Index (CPI) on Tuesday. Economists surveyed by Dow Jones expect the core CPI (excluding food and energy prices) to rise 0.3% month-over-month and 5.4% year-over-year, compared to increases of 0.3% and 5.7%, respectively, in December.

* Updates on several other economic measures are also due this week. They include the producer price index, retail sales, housing starts, and the Conference Board’s U.S. leading economic index.

* The fourth-quarter earnings reporting season is in its home stretch. Earnings reports from nearly 60 S&P 500 members are due this week. Applied Materials, Cisco Systems, Coca-Cola, and Deere are among the companies reporting.

* The U.S. Senate Committee on Banking, Housing, and Urban Affairs will hold a hearing on cryptocurrencies and digital assets.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023