The S&P 500 fell below the 4,000 mark for the first time since January, marking its third straight weekly loss. Stocks fell after the Fed’s preferred inflation measure exceeded economists’ forecasts, and leading retailers lowered their earnings projections. Investors will get plenty of input from Fed officials this week, with many scheduled to speak at engagements. Earnings reports from many retailers are also due.

U.S. stocks fell sharply last Friday after the core Personal Consumption Expenditures (PCE) price index exceeded economists’ forecasts in January.

The core PCE price index, the Fed’s preferred inflation measure that excludes food and energy expenditures, rose 0.6% in January, reflecting a rise of 4.7% over the past 12 months. Economists polled by Dow Jones had forecast the core PCE price index to rise 0.5% in January and 4.4% year over year.

Meanwhile, consumer spending rose 1.8% in January, exceeding economists’ forecast for a 1.3% increase.

The thought of inflation proving sticky worried investors. They feared the Federal Reserve would continue raising its federal funds rate well above 5% to bring down inflation.

Earlier last week, minutes from the Fed’s Jan. 31-Feb. 1 meeting showed officials agreeing that inflation remains well above the central bank’s 2% target. The bank’s officials also agreed on a tight labor market contributing to upward wage and price pressures.

Stocks fell at the start of the week after retailers provided bleak profit forecasts. Walmart lowered its full-year earnings guidance. The retailer said it expects higher-than-expected food inflation to pressure its profit margin. Home Depot warned of weakening demand and issued a grim 2023 profit forecast.

Earnings from semiconductor chipmaker NVIDIA provided some short-lived cheer. The company reported a surge in the use of its chips to power artificial intelligence services.

The yield on the two-year Treasury note ended the week at a four-month high of 4.78%. The 10-year note yielded 3.95%. The yield curve stayed steeply inverted at -0.83%.

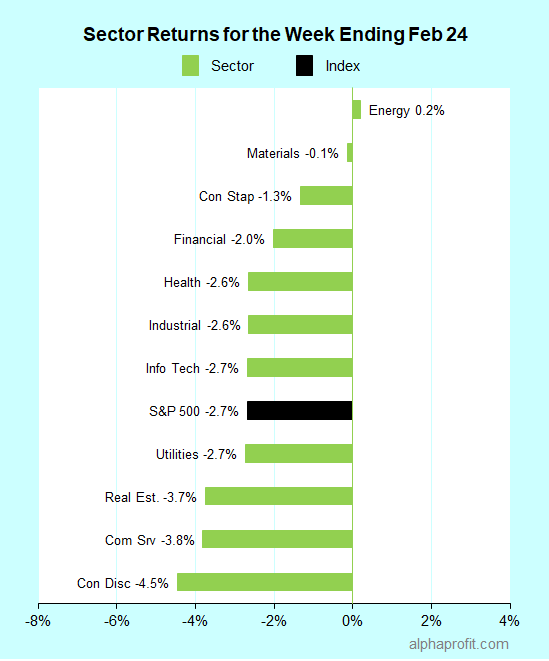

For the week ending February 24, the S&P 500 (SPY) fell 2.7%. Ten of the 11 sectors declined, with energy (XLE) being the exception. Consumer discretionary (XLY) lost the most.

The S&P 500’s top 10 winners included the following:

1. Energy Sector

- EQT Corp., (EQT) +9% – The week’s top performer in the S&P 500.

- Coterra Energy (CTRA) +4%

2. Materials Sector

- Linde PLC (LIN) +7%

3. Consumer Staples Sector

- General Mills (GIS) +7%

- Molson Coors Beverage (TAP) +5%

- Campbell Soup (CPB) +4%

4. Information Technology Sector

- ANSYS (ANSS) +7%

- NVIDIA Corp. (NVDA) +6%

5. Health Care Sector

- GE HealthCare Technologies (GEHC) +6%

- Bio-Rad Laboratories (BIO) +5%

Top ETFs for the week

The following ETF themes worked well: energy, natural gas, oil & gas exploration and production, U.S. dollar, consumer staples, food, and beverage. The top ETFs for the week include:

- United States Natural Gas Fund (UNG) +9.4%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +2.7%

- First Trust Energy AlphaDEX Fund (FXN) +2.7%

- Invesco DB US Dollar Index Bullish Fund (UUP) +1.4%

- First Trust Nasdaq Food & Beverage ETF (FTXG) +0.6%

Will Fed Comments and Retailer Earnings Sink Stocks?

* The S&P 500 fell below the 4,000 mark for the first time since January last week, closing fractionally above its 200-day moving average. Higher-than-expected inflation and lowered earnings projections from leading retailers weighed on stocks. Stocks could come under renewed pressure this week as several Fed officials speak and many retailers report earnings.

* Several Federal Reserve officials speak at engagements this week. The speakers include Fed Governors Bowman, Jefferson, and Waller and the Presidents of the Chicago, Dallas, and Minneapolis Federal Reserve banks. Investors will seek clues on the size of the next interest rate hike and the terminal fed funds rate after the core PCE price index exceeded economists’ forecast last Friday.

* The Institute of Supply Management’s reports on February factory and service activity indexes are arguably the main economic data points of the week. Investors will also receive updates on February consumer confidence from the Conference Board, January home prices from S&P Global, and weekly jobless claims from the Labor Department.

* Twenty-eight S&P 500 member companies report their quarterly earnings this week. The earnings reports from Costco, Lowe’s, Target, and specialty retailers AutoZone, Ross Stores, and Best Buy should provide investors with insights into consumer spending. Investors will also get a pulse on technology spending by enterprises when Broadcom and Salesforce report.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023