The S&P 500 rose 6.2% to record its highest weekly gain since November 2020. Investors sought bargains after the Fed provided clarity on interest rate policy. The lower-than-expected rise in the producer price index data and falling oil prices eased inflation concerns. Rising COVID cases in China and Europe added to uncertainties while the war in Ukraine continued.

The Federal Reserve raised its benchmark interest rate by 0.25% last week, the first increase since 2018. While the Fed acknowledged uncertainty from the Russia-Ukraine war, it said “ongoing increases” in the benchmark interest rate “will be appropriate” to curb the highest inflation in 40 years.

Fed Chairman Powell gave an optimistic view of the economy. The Fed forecast the benchmark interest rate would be 1.9% by year-end, implying the central bank would raise interest rates at each of the remaining meetings this year.

Investors received some relief on the inflation front. U. S. producer prices rose 0.8% in February, below economists’ 0.9% forecast. The core producer price index, which excludes food and energy components, rose just 0.2% compared to economists’ 0.6% forecast. Further, the price of oil retreated over 4% last week.

Rising daily COVID infections disrupted manufacturing activity in Shenzhen, a hub after China shut down nonessential businesses imposed city-wide testing. China’s promise to roll out more stimulus and keep markets stable helped offset investors’ fears of additional disruptions to global supply chains.

Fighting between Russia and Ukraine continued despite signs of potential progress in negotiations between the two countries. Hinting a compromise, Ukraine’s President Zelenskyy said he is prepared to accept security guarantees instead of membership in the NATO alliance membership. Russia also avoided a foreign currency debt default by paying $117 million in bond payments due.

Investors sought bargains in high-growth companies and names most punished in 2022.

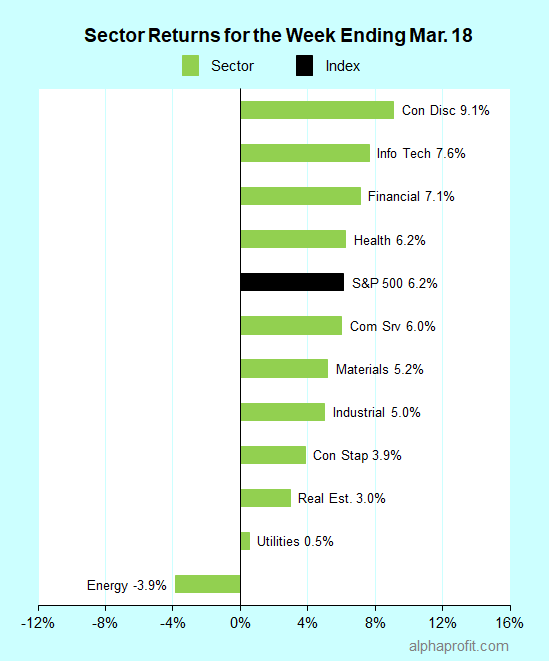

For the week ending March 18, the S&P 500 (SPY) rose 6.2%. Ten of the 11 sectors advanced, with energy being the exception.

Leading and lagging sectors as the market shows bottoming signs amidst rising recession risks – March 18, 2022.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by an 8-to-1 ratio.

Consumer discretionary (XLY), information technology (XLK), and financials (XLF) led the S&P 500, gaining 7.0% or more.

Energy (XLE), utilities (XLU), and real estate (XLRE) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Information Technology

EPAM Systems (EPAM) +47% – Beaten-down shares of the information technology services provider rebounded on improving risk appetite. EPAM Systems, with large delivery centers in Belarus, Russia, and Ukraine, gained 47% to be the week’s top performer in the S&P 500.

PayPal (PYPL) +23% – The payment services provider gained after positive comments from Deutsche Bank and MoffettNathanson.

NVIDIA Corp. (NVDA) +20% – The semiconductor chipmaker rallied ahead of its flagship technical conference this week. Positive comments from Cowan added to investor enthusiasm.

2. Industrials

Nielsen Holdings (NLSN) +40% – The media ratings giant surged the Wall Street Journal reported on Elliott Investment Management and Brookfield Asset Management leading a consortium to buy Nielsen.

United Airlines (UAL) +21% and American Airlines (AAL) +19% – Major airlines boosted their current quarter revenue outlook, citing robust bookings from the recovery in travel demand.

3. Health Care

Moderna (MRNA) +29% – The COVID vaccine maker stock rallied after Moderna sought U. S. FDA approval for a second booster for adults 18 years or older. A surge in COVID cases in China’s Shenzhen region boosted Moderna shares.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- Glucose monitoring device maker DexCom (DXCM) +20%

- Online marketplace Etsy (ETSY) +22%

- Payroll software solutions provider Paycom Software (PAYC) +18%

Top ETFs for the week

The following ETFs themes worked well: China Internet, fintech, Internet, e-commerce, innovation, and cloud computing. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) +28.8%

- ARK Fintech Innovation ETF (ARKF) +22.8%

- EMQQ The Emerging Markets Internet & Ecommerce ETF (EMQQ) +21.3%

- ARK Innovation ETF (ARKK) +18.3%

- WisdomTree Cloud Computing Fund (WCLD) +15.4%

Top Fidelity Fund for the week

- Fidelity Select Semiconductors (FSELX) +13.1%

Will Market Bottom Endure as Recession Risk Rises?

Stocks appeared to bottom last week after they embarked on a robust rally. The Federal Reserve’s first interest rate hike of this cycle is in place. Investors are worried about the rising odds of a recession due to the Fed’s plan for six more interest rate increases this year. Investors are now monitoring to see if this rally has more to go. The deterioration of the market’s technical picture, an increase in COVID cases in China and Europe, and the crisis in Ukraine add to investors’ concerns.

* Stocks made robust gains last week. Yet, the rally could not prevent the S&P 500 from forming a death cross. The S&P 500’s 50-day moving average (DMA) fell below its 200-DMA last week. Investors are waiting to see if stocks can extend last week’s rally into this week. If stocks can muster further gains, the S&P 500 could form a golden cross relatively soon. A cross of the 50-DMA back above the 200-DMA would provide relief to technically inclined investors.

* The backdrop of falling oil prices soothed investors last week as the yield on the 10-year Treasury bond rose 0.14%. Investors will continue to monitor oil prices and bond yields this week. A renewed surge in the price of oil can quickly undermine investor confidence.

* The headlines from the war in Ukraine and the renewed surge in COVID cases in China & Europe can continue to drive volatility this week.

* Nearly a dozen Fed officials speak this week. Fed Chairman Powell speaks at an economics conference on Monday and an international banking conference on Wednesday.

* Adobe, Cintas Corp., Colgate-Palmolive, General Mills, and Nike are among the S&P 500 members reporting earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023