U.S. stocks gave back some of the gains made in the past two weeks. Investors feared the Fed would push interest rates high enough to cause a recession. Data pointing to growth in the service segment of the economy and stickiness in wholesale price inflation drove these fears. Wall Street is focused on two events this week: the November consumer price index data and the Fed’s last interest rate policy meeting of 2022.

Investors worried that a robust economy would drive the Federal Reserve to raise interest rates higher to lower inflation and push the economy into recession.

The Institute of Supply Management’s services activity index gained in November to stoke such concerns. The index rose by 2.1% from October to 56.5%, topping economists’ forecast of 53.7% in a Dow Jones survey. The employment component of the index rebounded, suggesting momentum in the economy.

Somber comments from the CEOs of JPMorgan Chase and Bank of America also unnerved investors. They said inflation is eroding consumer spending power and raising the odds of two-to-three quarters of economic contraction next year.

Investors received an update on wholesale price inflation from the Bureau of Labor Statistics (BLS). The report suggested inflation may be sticky and slow to retreat.

The BLS reported that the producer price index rose 0.3% in November as the cost of services increased. Economists surveyed by Dow Jones forecast the PPI to rise by 0.2% in November. The PPI rose 7.4% from a year ago. Excluding food and energy costs, the core PPI rose 0.4% last month and 6.2% from a year ago.

China eased its “zero-COVID” policy. The Chinese government said people would no longer be required to show negative virus tests or health codes to travel within the country.

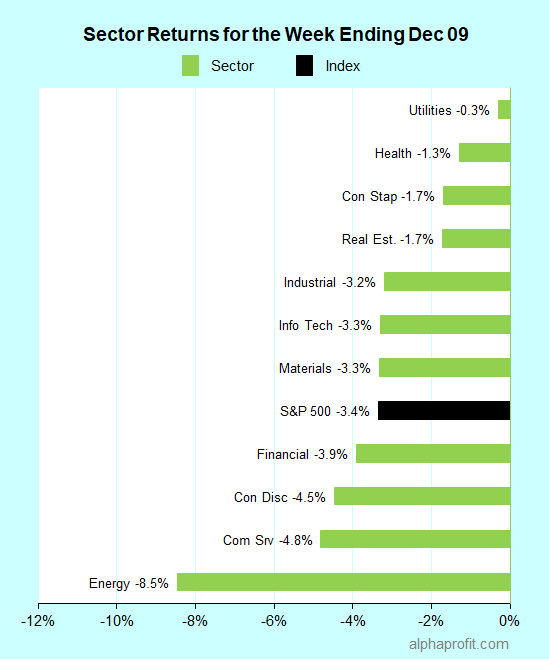

For the week ending December 09, the S&P 500 (SPY) fell 3.4%. All of the 11 sectors declined.

Utilities (XLU) lost the least, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Utilities Sector

- Evergy, (EVRG) +7% – The week’s top performer in the S&P 500.

- CMS Energy (CMS) +3%

- DTE Energy (DTE) +2%

2. Consumer Staples Sector

- Newell Brands (NWL) +3%

- Campbell Soup (CPB) +3%

3. Real Estate Sector

- Realty Income (O) +2%

4. Information Technology Sector

- Seagate Technology (STX) +2%

- SolarEdge Technologies (SEDG) +2%

5. Health Care Sector

- Molina Healthcare (MOH) +2%

- Teleflex (TFX) +2%

Top ETFs for the week

The following ETF themes worked well: China, Hong Kong, silver, and Japan. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) 4.0%

- iShares MSCI Hong Kong ETF (EWH) 3.9%

- iShares MSCI China ETF (MCHI) 2.1%

- iShares Silver Trust (SLV) 1.3%

- WisdomTree Japan Hedged Equity Fund (DXJ) 1.3%

Will Powell Allow Santa on Wall Street This Year?

* The Bureau of Labor Statistics (BLS) reports data on inflation at the retail level this week after reporting data on wholesale price inflation last Friday. On Tuesday, the BLS updates the November reading for the consumer price index (CPI). TradingEconomics.com forecasts the CPI to show a 7.6% increase for the 12 months ending in November, down a tad from 7.7% in October. Core inflation, which excludes food and energy costs, is expected to fall to 6.2% from 6.3% in October.

* The Federal Open Market Committee meets on Tuesday and Wednesday this week to discuss interest rate policy. Market participants expect the Fed to raise the federal funds rate by 0.50% to the 4.25–4.50% range. In light of the continued strength shown by the labor market and stickiness in inflation, investors are eager to hear what the Fed has to say on the terminal interest rate and the outlook for the economy.

* A handful of S&P 500 member companies, including Accenture, Darden Restaurants, Lennar, Nordson, and Oracle, are due to report earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023