Last week, the S&P 500 surged 6.6%, snapping a 7-week losing streak. The week is packed with economic data releases, despite being shortened by the Memorial Day holiday. The May jobs report is the highlight of the week that includes readings on consumer confidence, manufacturing activity, and service activity.

The S&P 500 surged 6.6% last week, ending the 7-week rout in U. S. stocks.

Investors reacted positively to the minutes from the Federal Reserve’s interest rate policy meeting in early May. The minutes reaffirmed the central bank’s commitment to rein in inflation while remaining responsive to economic data. Investors surmised that the Fed could pause interest rate increases by the third quarter if it front-loads them, as discussed in the meeting.

The April reading on the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) index, gave stocks another lift. The PCE index showed price pressures easing in April. The inflation rate declined for the first time in a year and a half. The annual inflation rate slowed to 6.3% in April from a 40-year high of 6.6% in March, raising hopes of a peak in inflation.

Due to peaking inflation, investors lowered their expectations of the Fed raising interest rates for the remainder of 2022. Bond yields dipped a tad last week as the 10-year yield ended about 0.04% lower at 2.74%.

Separately, the Commerce Department reported consumer spending increased 0.9% in April, compared to economists’ 0.7% forecast. Gains in wages supported the growth in consumer spending. This resiliency in consumer spending boosted investors’ confidence in the economy’s ability to avoid a recession.

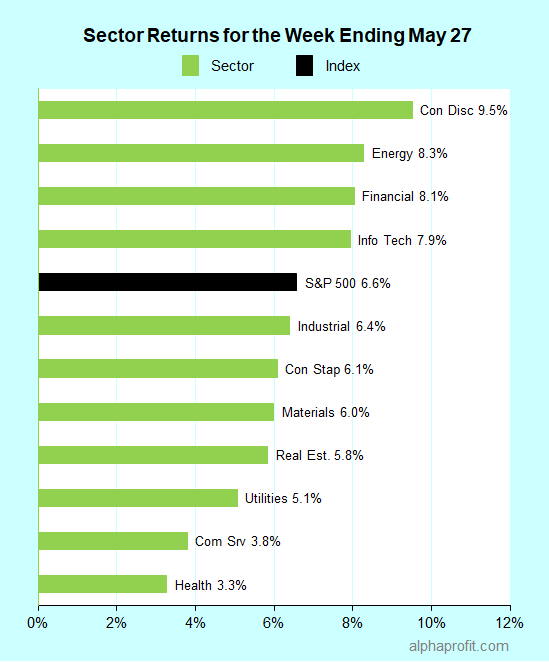

For the week ending May 27, the S&P 500 (SPY) rose 6.6%. All of the 11 sectors advanced.

Market breadth was overwhelmingly positive. The number of advancing stocks in the S&P 500 swamped the number of decliners by a 49-to-1 ratio.

Consumer discretionary (XLY), energy (XLE), and financials (XLF) led the S&P 500, gaining 8.1% or more.

Health care (XLV), communication services (XLC), and utilities (XLU) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Consumer Discretionary Sector

- Dollar Tree (DLTR) +29% – The week’s top performer in the S&P 500.

- Ulta Beauty (ULTA) +24%

- Dollar General (DG) +22%

- Ross Stores (ROST) +21%

- Best Buy Co. (BBY) +16%

- AutoZone (AZO) +16%

2. Information Technology Sector

- DXC Technology (DXC) +19%

3. Utilities Sector

- Constellation Energy (CEG) +18%

4. Energy Sector

- Schlumberger Ltd. (SLB) +17%

- Diamondback Energy (FANG) +17%

Top ETFs for the week

The following ETFs themes worked well: oil & gas, retailing, metals & mining, and clean energy. The top ETFs for the week include:

- First Trust Natural Gas ETF (FCG) +15.8%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +14.8%

- SPDR S&P Retail ETF (XRT) +10.1%

- SPDR S&P Metals and Mining ETF (XME) +9.9%

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) +9.8%

Top Fidelity Fund for the week

- Fidelity Select Retailing (FSRPX) +10.4%

Will Stocks Extend or Snap Their One Week Rally?

* The Labor Department’s May jobs report, due on Friday, is the main event of the Memorial Day holiday-shortened week. Economists surveyed by The Wall Street Journal expect job creation to fall to 325,000 in May from 428,000 in April. They expect the unemployment rate to dip to 3.5% in May from 3.6% in April. Sub-par job creation can be a positive for stocks, while a larger-than-expected drop in the unemployment rate can be a negative.

* In other economic data, the Institute of Supply Management’s factory and services activity measures come out on Wednesday and Friday, respectively. The May Chicago purchasing managers’ index and the May consumer confidence index are due on Tuesday.

* Several information technology companies in the S&P 500 report this week. They are Hewlett Packard Enterprise, HP Inc., NetApp, and Salesforce. Food products company Hormel, apparel maker PVH Corp., and medical device company Cooper are others reporting.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023