The Fed upped the federal funds rate by 0.75% last week. It also signaled that interest rates would rise by another 1.25% before year-end. Bond yields soared to multi-year highs. Investors are worried the Fed’s fight against inflation will start a new recession. Trading in the final week of the third quarter starts with the S&P 500 just 1.5% above its 2022 low. A break below the June low could result in the benchmark probing its pre-pandemic highs. New inflation data are due this week.

The Federal Reserve lifted its benchmark federal funds rate by 0.75% to the 3.00–3.25% range on Wednesday, September 21.

Fed Chair Powell said U.S. central bank officials are “strongly resolved” to lower inflation from the highest levels in four decades and “will keep at it until the job is done.”

Fed officials predicted that the federal funds rate would be in the 4.25–4.5% range by year-end, implying interest rates would rise 1.25% in November and December combined.

The central bank’s economic projections showed gross domestic product growth of just 0.2% in 2022 and 1.2% in 2023, sharply lower than the prior forecast. The unemployment rate, currently at 3.7%, is expected to rise to 4.4% next year.

Investors saw the Fed’s stance on interest rates in the face of the above economic forecast as a willingness to tolerate a U.S. recession.

The risks of a global recession also rose as several other central banks upped interest rates. The central banks in England and Norway raised their benchmark interest rates by 0.5%, while those in Switzerland and Hong Kong raised them by 0.75%.

The yields on the 10-year and 2-year Treasury notes surged to new multi-year highs. The yield on the 10-year and 2-year notes rose 0.25% and 0.35%, respectively, to close the week at 3.7% and 4.2%, respectively.

The U.S. dollar index hit its highest level since 2002 while oil prices dropped below $80 a barrel for the first time since January.

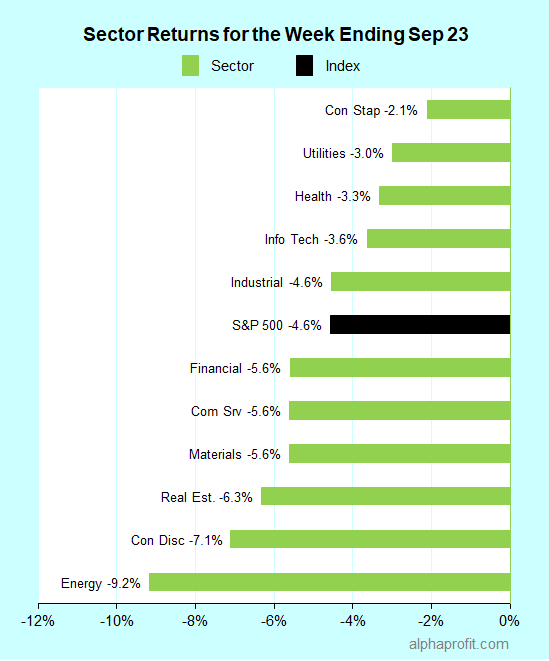

For the week ending September 23, the S&P 500 (SPY) fell 4.6%. All of the 11 sectors declined.

Consumer staples (XLP) fell the least, while energy (XLE) fell the most.

The S&P 500’s top 10 winners included the following:

1. Consumer Staples Sector

- General Mills (GIS) +5% – The week’s top performer in the S&P 500.

- Kellogg (K) +3%

- Hormel Foods (HRL) +2%

- Campbell Soup (CPB) +2%

- Hershey (HSY) +2%

- Conagra Brands (CAG) +2%

- Lamb Weston (LW) +1%

- J. M. Smucker (SJM) +1%

2. Industrial Sector

- Allegion PLC (ALLE) +3%

3. Consumer Discretionary Sector

- Lennar LEN) +2%

Top ETFs for the week

The following ETF themes worked well: U.S. dollar, managed futures, Brazil, floating rate bonds, short-term treasury bonds. The top ETFs for the week include:

- Invesco DB US Dollar Index Bullish Fund (UUP) 3.1%

- iMGP DBi Managed Futures Strategy ETF (DBMF) 2.8%

- iShares MSCI Brazil ETF (EWZ) 2.5%

- iShares Floating Rate Bond ETF (FLOT) 0.2%

- iShares 0-3 Month Treasury Bond ETF (SGOV) 0.1%

Will Stocks Hold Above Pre-COVID Highs This Week?

* The final week of the third quarter has often proved difficult for stocks. Last week, the Dow Jones Industrial Average fell below 30,000 to set a new 2022 low. The S&P 500 closed within 1.5% of its 2022 low set intraday on June 17. Investors are anxious to see if the benchmark finds support around the 3,635 mark. A break below 3,635 could result in the index falling below 3,400. The S&P 500 topped around 3,400 before the pandemic in February 2020.

* The update on the Federal Reserve’s preferred inflation gauge is due. Economists surveyed by Dow Jones expect the Personal Consumption Expenditures (PCE) Price Index to increase 0.5% in August from July. They expect the PCE to rise by 4.7% on a year-over-basis. For comparison purposes, the PCE rose 0.1% in July and showed a year-over-year increase of 4.6%.

* The Conference Board’s Consumer Confidence Index for September and new home sales in August are economic data due this week.

* The S&P 500 member companies reporting this week include CarMax, Cintas, Micron Technology, Nike, and Paychex.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023