The S&P 500 fell 0.2%, marking its fifth straight weekly loss. The outcome for the week did not reflect the volatility in stocks. Investors eagerly bid up stock prices after Fed Chair Powell expressed confidence in taming inflation without triggering a recession. This belief soon gave way to anxiety amidst rising fears of stagflation.

Stocks surged to their best gain in nearly two years on Wednesday. The Fed raised its fed funds target rate by 0.5%. Investors reacted enthusiastically to Federal Reserve Chair Powell’s remarks after the May 2-3 interest rate policy meeting.

Powell said that the Fed was not actively considering interest rate hikes of 0.75% during interest rate policy meetings. Powell asserted that the Fed should be able to lower inflation without grinding economic growth to a halt.

The rally, however, unraveled on Thursday as investors had second thoughts. They surmised that the Fed was falling further behind in its effort to tame surging inflation. Investors feared the Fed would eventually have to aggressively raise interest rates in its fight against inflation and topple the economy into recession.

Economic data raised stagflation fears. The April employment report showed healthy job creation with relatively low wage pressure. The Labor Department reported the U. S. economy added 428,000 new jobs, generally in-line with the 400,000 new jobs forecasted by economists. Average hourly earnings rose 0.3%, a tad below economists’ forecast for a 0.4% increase. The unemployment rate was unchanged at 3.6%.

Investors interpreted the sharp drop in productivity in the first quarter amidst the continued rise in wages as signs of stagflation.

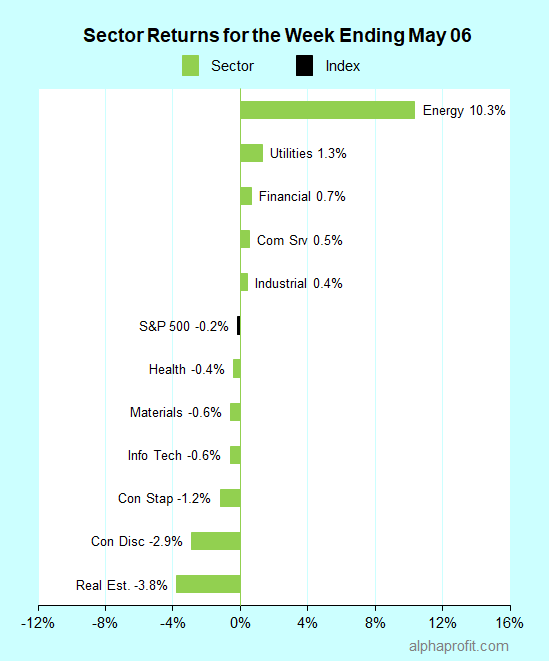

For the week ending May 6, the S&P 500 (SPY) fell 0.2%. Five of the 11 sectors advanced.

Leading and lagging sectors for the week ending May 6, 2022, before April consumer price index data.

Market breadth was neutral. The number of advancing and declining stocks in the S&P 500 was nearly equal.

Energy (XLE), utilities (XLU), and financials (XLF) bucked the S&P 500, gaining 0.7% or more.

Real estate (XLRE), consumer discretionary (XLY), and consumer staples (XLP) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- EPAM Systems (EPAM) +31%

- Monolithic Power Systems (MPWR) +13%

Battered shares of IT services provider EPAM Systems surged after its first-quarter sales and EPS topped analysts’ forecasts. EPAM has significant exposure to Russia and Ukraine. Up 31% for the week, EPAM shares were the week’s top performer in the S&P 500.

2. Materials Sector

- Albemarle Corp. (ALB) +26%

Shares of the lithium producer surged after Albemarle raised its full-year sales and EPS guidance by 24% and 75%, respectively.

3. Energy Sector

- Devon Energy (DVN) +20%

- Occidental Petroleum (OXY) +18%

- Pioneer Natural Resources (PXD) +16%

- Valero Energy (VLO) +16%

- Hess Corp. (HES) +14%

- EOG Resources (EOG) +13%

Energy shares fared well as oil and gas prices rose 6% and 11%, respectively, for the week. Prices of energy commodities rose on supply concerns as the European Union proposed to phase out Russian crude oil in six months and refined products by the end of 2022. Oil & gas producers Devon Energy, Pioneer Natural Resources, and EOG Resources posted upbeat quarterly earnings reports.

4. Utilities Sector

- NRG Energy (NRG) +15%

The electric utility reversed losses from a year ago and reported EPS of $7.17 for the first quarter, well above analysts’ EPS estimate of $0.62.

Top ETFs for the week

The following ETFs themes worked well: energy including carbon credits & MLPs and dividend-yielding stocks. The top ETFs for the week include:

- iShares U.S. Oil & Gas Exploration & Production ETF (IEO) +11.3%

- Energy Select Sector SPDR Fund (XLE) +10.3%

- KraneShares Global Carbon ETF (KRBN) +6.1%

- Alerian MLP ETF (AMLP) +4.9%

- First Trust Morningstar Dividend Leaders Index Fund (FDL) +3.1%

Top Fidelity Fund for the week

- Fidelity Select Energy (FSENX) +9.3%

Will Stocks Recover from their 5-Week Rut

Stocks could see significant moves either up or down next week in response to inflation data, bond yields, and the war in Ukraine.

* The April consumer price index is the next major inflation signpost. Economists surveyed by Dow Jones expect the April CPI reading to show a year-over-year increase of 8.1% on Wednesday, slightly below the 8.6% annual change in March. Signs of peaking inflation can bring some stability to both stocks and bonds.

* The relentless increase in the 10-year Treasury bond yield continued last week. The bond yield rose 0.2% last week. It topped 3.0% for the first time since November 2018, closing at 3.1%. Signs of peaking inflation can, at the very least, slow the rate of increase in bond yields.

* Russia observes the Victory Day holiday on May 9, commemorating its triumph over Nazi Germany in 1945. The Kremlin has often used Victory Day to stir patriotic pride and emphasize Russia’s role as a global power. Military strategists have voiced concern that Russian President Putin may escalate attacks on Ukraine on this occasion.

* Regarding downside risks to stocks, the S&P 500 came within 68 points of breaking 4,000 last week before rallying to end Friday at 4,123. Technical analysts believe Apple and Microsoft hold the keys to supporting the S&P 500. The S&P 500 could drop below 4,000 if shares of Apple and Microsoft fall below $150 and $270, respectively.

* Disney, Duke Energy, Occidental Petroleum, Sysco, and Simon Property Group are among the S&P 500 companies reporting this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023