Commodity prices continued to soar as the fighting in Ukraine continued for the third week, threatening to worsen inflation. Bonds yields resumed their uptrend while stocks suffered steep losses.

The fighting in Ukraine extended to the third week after Russia’s invasion. Peace talks between the two countries did not yield results.

The sanctions imposed by the U. S. and its allies on Russia continued to push commodity prices higher due to Russia’s standing as a dominant producer of several commodities.

Early last week, oil touched $130 a barrel, a level not seen since 2008 on worries over the impact of sanctions on Russian oil supplies. The U. S. and Western oil companies banned purchases of Russian oil. Oil pulled back to end the week below $110 a barrel. The nationwide average price of gasoline jumped by almost 50 cents a gallon last week to close at $4.33 a gallon.

While oil got most of the attention, the prices of other commodities such as wheat, fertilizers, nickel, and palladium also spiraled higher.

The Labor Department reported consumer prices surged 7.9% during the 12 months ending in February, the hottest inflation reading in forty years. Gasoline prices rose 6.6% in February, pushing the consumer price index (CPI) higher by 0.8% from January.

Bond yields, which had fallen earlier in the month on their safe-haven appeal, turned around due to fears of rising inflation and closed the week higher.

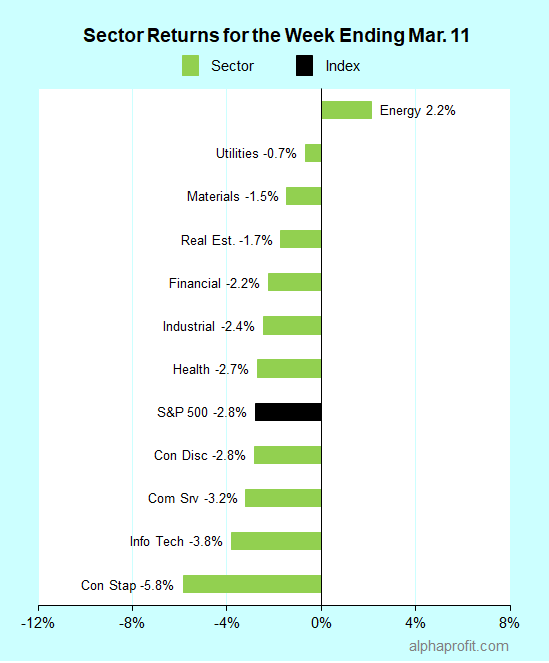

For the week ending March 11, the S&P 500 (SPY) fell 2.8%. Ten of the 11 sectors declined, with energy being the exception.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 1-to-4 ratio.

Energy (XLE), utilities (XLU), and materials (XLB) fared better than the S&P 500.

Consumer staples (XLP), information technology (XLK), and communication services (XLC) lagged the S&P 500, losing 3.2% or more.

The S&P 500’s top 10 winners included the following:

1. Energy

Oil service company shares fared well last week, bucking the decline in oil prices. U. S. government officials called on domestic and global producers to ramp up output. U. S. rig data showed drillers added 13 oil and natural gas rigs, bringing the total to 663, the ninth increase in 10 weeks.

Oil service firm Baker Hughes (BKR) rose 13% to be the week’s top performer in the S&P 500. Oil service heavyweights Schlumberger (SLB) and Halliburton (HAL) gained 10% each.

2. Industrials

Quanta Services (PWR) +13% – The construction services company gained as the energy costs continued to spiral higher. Quanta provides services to oil & gas firms and electrical grids. Quanta formed a new Renewable Energy segment in late February. The Renewable Energy segment services solar and wind projects.

3. Information Technology

SolarEdge Technologies (SEDG) +8% and Enphase Energy (ENPH) +8% – Solar energy-related technology stocks rose as higher oil prices make energy production from alternative sources more competitive.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- Chemical manufacturer LyondellBasell Industries (LYB) +6%

- Heavy Construction equipment maker Caterpillar (CAT) +10%

- Integrated oil company Chevron (CVX) +8%

- Oil refiner and marketer Valero Energy (VLO) +7%

Top ETFs for the week

The following ETFs themes worked well: uranium, carbon credits, oil services, solar energy, and clean energy. The top ETFs for the week include:

- North Shore Global Uranium Mining ETF (URNM) +16.4%

- KraneShares Global Carbon ETF (KRBN) +12.3%

- VanEck Oil Services ETF (OIH) +9.9%

- Invesco Solar ETF (TAN) +8.3%

- iShares Global Clean Energy ETF (ICLN) +6.6%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +3.3%

Will Ukraine and Oil Dominate the Fed?

The Federal Open Market Committee meets on March 15-16 to discuss interest rate policy. The FOMC meeting would usually be the most important event of the week. With the Fed’s decision to raise interest rates unlikely to surprise investors, the central bank’s comments on the outlook for interest rates, inflation, and the economy can still be a market mover. That said, events from the Russia-Ukraine war and their impact on oil and bond prices can overshadow the Fed. Earnings reports can provide insights into the state of the economy.

* Financial markets are likely to remain volatile, reflecting uncertainty from the war in Ukraine. Stocks are likely to take their cues from bonds and oil. The bond market has held its own until now, although bid-ask spreads have widened since Russia invaded Ukraine. Stocks could suffer if these spreads continue widening and counterparty credit risks increase.

* The drop in oil prices in the second half of last week was a good development for investors, as it alleviated inflation concerns. This week, the oil market will focus on estimates of Russian oil supply volumes impacted by sanctions. Oil’s return to $130 per barrel could pressure stocks.

* Investors may take the Federal Reserve’s first post-pandemic interest rate hike in stride. Investors expect the Federal Reserve to raise its target fed funds rate by 0.25% after the interest rate policy-setting Federal Market Committee Meets on March 15 and 16. The central bank’s interest rate, inflation, and economic growth forecasts, as well as comments on its plans for shrinking the $9 trillion balance sheet, are likely to move markets.

* Although the flow of earnings reports slows to trickle this week, investors stand to receive meaningful insights from those reporting. Investors will look to earnings reports from Accenture, Dollar General, and FedEx for comments on the impact of the war in Ukraine on IT spending, consumer spending, and transport volumes.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023