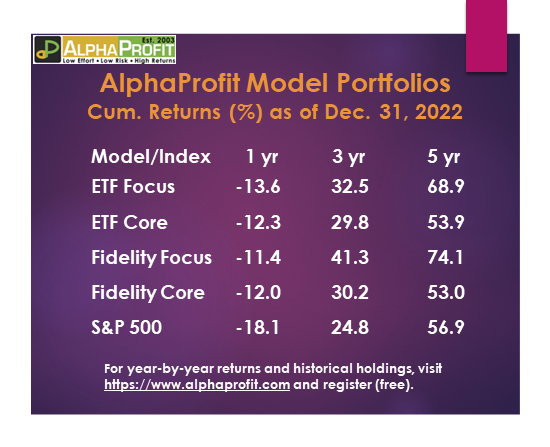

Here are the recent cumulative returns for the ETF and Fidelity model portfolios as of December 31, 2022:

The AlphaProfit Core and Focus model portfolios outperformed the S&P 500 in 2022. They have also outperformed the benchmark over the past three years.

Over the past five years, two of the AlphaProfit model portfolios have beaten the S&P 500.

AlphaProfit analyzes sectors based on valuation, momentum, and news quality to select sector ETFs and thematic ETFs for the AlphaProfit ETF and Fidelity Core & Focus model portfolios.

AlphaProfit uses a similar process to choose Fidelity Select funds, Fidelity Sector funds, and Fidelity Thematic funds for the AlphaProfit Fidelity Core & Focus model portfolios.

A dollar invested in this selection process in 1994 is now worth $108.04, while a comparable investment in the S&P 500 is worth just $14.38.

In other words, AlphaProfit’s sector selection process has earned a 17.5% compound annual return, including the COVID crisis, the Great Recession, and the dot-com bust.

AlphaProfit Premium Service subscribers have THREE additional ways to make money in addition to the Core and Focus model portfolios.

1. Stock Recommendations

AlphaProfit features attractively valued stocks with favorable near-term prospects on the 12th of each month. The stock recommendations enable Premium Service subscribers to profit from short-term opportunities.

During the past 12 months, volatility created by inflation and interest rate concerns has provided several profit opportunities.

Here are the gains scored by AlphaProfit subscribers in 2022.

- Chemours (CC) +18.3%

- EOG Resources (EOG) +18.2%

- KB Home (KBH) +18.5%

- Lithia Motors (LAD) +19.4%

- Steel Dynamics (STLD) +17.9%

- Chemours (CC) * +20.4%

- TotalEnergies (TTE) +11.5%

- FedEx Corp (FDX) +18.3%

- United Rentals (URI) +22.4%

- Marriott Intl. (MAR) +19.0%

- Owens Corning (OC) +23.7%

- Diamondback Energy (FANG) +29.4%

- Reins Grp of America (RGA) +11.5%

- AGCO Corp. (AGCO) +20.9%

- Coterra Energy (CTRA) +19.5%

- Paccar (PCAR) +14.6%

- United Rentals (URI) * +16.2%

- Fortune Brands H&S (FBHS) +16.5%

- Marriott Intl. (MAR) * +13.7%

- Broadcom (AVGO) +13.2%

* New recommendation after the previous sale

Additional details, including the recommendation date, buy date, buy price, sell date, and sell price, are available to registered users. Registration is free.

AlphaProfit stock recommendations have returned 4.8% a month on average since 2009, with a 91% win rate.

2. Domestic, Foreign, and Specialty Fund Recommendations

Since March 2009, the NL-NTF Growth model portfolio has helped AlphaProfit subscribers quadruple their money.

As of December 18, the NL-NTF Growth model portfolio is up 314.5%, well in excess of the 233.2% return of its benchmark consisting of broad domestic and foreign stock indexes.

The NL-NTF Growth Model portfolio has consistently outperformed its benchmark over the 3-year, 5-year, and 10-year periods.

3. Income Recommendations

AlphaProfit provides a list of ETFs and no-load, no-transaction-fee mutual funds for capital preservation and income objectives.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

Sector ETF model portfolios from AlphaProfit

Performance of AlphaProfit's ETF model portfolios

How AlphaProfit helps you invest in the best sector ETF consistently

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023