Read this article to learn how you can maximize return from the best natural gas mutual funds, best natural gas ETFs, and best natural gas stocks.

Excess natural gas production from shale formations resulted in a supply glut in 2010 and pressured natural gas prices.

Planned cuts in natural gas production at the beginning of this year crimped supply. Rising industrial demand, a colder-than-normal winter, and an extremely hot July have since then contributed to an increase in demand. The shrinking gap between natural gas demand and supply has helped to work off excess inventories. Natural gas inventory levels have declined over 4% from the year-ago level; they are now 2% below their 5-year average.

Inventories are likely to tighten further if power producers continue shifting from coal and fuel oil to cleaner burning natural gas. Natural gas prices can increase as inventories tighten.

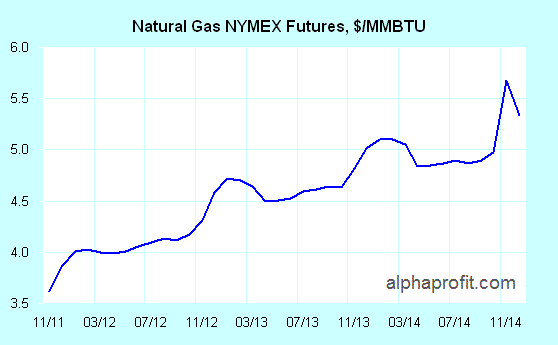

Natural gas futures traders support this bullishness. NYMEX natural gas futures rise from $3.93 per MMBTU for October 2011 delivery to $4.25 for December 2011 delivery. The price for December 2012 delivery rises 26% to $4.95. The price curve rises through 2014 in a virtual straight-line tagging another 12%. The contract for December 2014 delivery changes hands at $5.56.

Growth as well as income investors can profit from an expected increase in natural gas prices by investing in the best natural gas mutual funds, best natural gas ETFs, and best natural gas stocks.

Rising natural gas demand and prices translates into opportunity for companies in different segments of the gas value chain. They include natural gas producers, service firms and natural gas distributors. This in turn opens up investment opportunities for mutual fund, ETF, and stock investors looking for growth as well as income.

Best Natural Gas Mutual Funds for Growth

Fidelity offers a wide range of actively managed sector mutual funds under the Fidelity Select funds family. Fidelity Select Natural Gas (FSNGX) is a pure-play no-load natural gas mutual fund. See: How to choose the best Fidelity Select fund

Best Natural Gas Mutual Funds for Income

FBR Gas Utility Index (GASFX) appeals to investors seeking income from investments in natural gas transportation and distribution companies. This natural gas mutual fund invests in utilities, master limited partnerships, and other companies included in the American Gas Association Stock Index.

Best Natural Gas ETFs for Growth

First Trust ISE-Revere Natural Gas Index ETF (FCG) is a pure-play natural gas ETF investing in natural gas exploration, production, and service companies. See: Invest in the Best Sector ETFs Consistently

Best Natural Gas ETFs for Income

JP Morgan Alerian MLP Index ETN (AMJ) and Alerian MLP ETF (AMLP) invest in U. S. energy infrastructure master limited partnerships. While the ETN tends to be more volatile and can offer higher return potential in bull markets, investors seeking tax-deferred distributions usually prefer the ETF structure.

Best Natural Gas Stocks for Growth

Devon Energy (DVN) has successfully transformed itself as a high-growth onshore company and emerged as the largest natural gas producer in the Barnett shale. Devon’s dominant position in the Barnett shale is complemented with liquids rich-assets in the Permian Basin. Devon has a well-defined program for increasing production and strong cash flow from current operations should help fund growth prospects. Devon Energys EPS is likely to increase 21% in 2012 and another 20% in 2013.

National Fuel Gas (NFG) is poised to benefit from growth in production and transportation volumes of natural gas. NFG is one of the biggest leaseholders in the Marcellus shale formation with 745,000 acres. Marcellus shale is likely to help NFG increase its total production by over 30% next year. The diversified gas company should also see higher profits from its expanding gas pipeline network. NFG’s EPS is likely to increase 13% in 2012 and another 19% in 2013.

Best Natural Gas Stocks for Income

Targa Resouces (NGLS) is a limited partnership engaged in the business of gathering and selling natural gas and natural gas liquids. This partnership’s competitive position is strong by virtue of its access to Henry Hub, the largest U. S. natural gas hub, along with a formidable NGL distribution system in Louisiana and the southeast. Targa’s NGL business benefits from the wide price differential between crude oil and natural gas. Targa has increased its dividend distribution by over 10% since 2009 and its stock currently yields nearly 7%.

Williams Partners (WPZ) provides natural gas to utilities and natural gas liquids to petrochemical companies. The limited partnership’s investments in the Marcellus Shale, Piceance Basin, and Gulf of Mexico are paying off. Williams is expanding pipeline capacity as utilities increasingly switch to natural gas-fired power plants and demand for NGLs from petrochemical companies stays strong. Williams dividend payout is very well covered by distributable cash flow even though the partnership has raised dividends for six straight quarters. The limited partnerships shares yield nearly 5.4% and the distributions are likely to increase between 6% and 10% in 2012.

Beat the Market with Best Natural Gas Mutual Funds and Best Natural Gas ETFs

While growing demand for natural gas can make natural gas investments suitable for long-term investing, you can use such investments as part of a broader sector investing strategy to earn bigger rewards.

Like most sector investments, natural gas investments periodically come in and go out of favor based on investors view of near-term prospects for natural gas companies.

AlphaProfit’s Investments Newsletters help you invest in the best natural gas mutual fund and best natural gas ETF at the right time.

When the timing is just not right for natural gas mutual funds or natural gas ETFs, you will stay away from them and invest only in the best sector mutual funds and best sector ETFs in the top ranked sectors.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023