U. S. stocks lost further ground as they continued to struggle for their first weekly gain in 2022. Investors worried about the Fed aggressively tightening interest rate policy in response to high inflation. The S&P 500 fell below its 200-day moving average, hampered by the sharp rise in bond yields, disappointing earnings reports, and tepid economic data.

Worries of the Federal Reserve responding aggressively to stem inflation spilled over into this holiday-shortened trading week on hawkish comments from Federal Reserve officials. Investors reflected on U. S. consumer prices showing the highest annual rise in nearly four decades In December.

The yield on the 10-year Treasury note spiked quickly by 0.1% to 1.87% after starting the week at 1.77%, marking its highest level since December 2019.

Earnings reports gave investors angst. Earnings at Goldman Sachs and Netflix fell short of expectations. The cautious 2022 outlook provided by banks sapped analyst’s enthusiasm to raise earnings expectations for the coming quarters. Upward earnings revisions fell below 59% in January from 72% last month.

Increasing investor angst, the uptick in weekly jobless claims, and disappointing existing home sales suggested the economy is losing momentum due to the omicron coronavirus variant.

Stocks had trouble holding up against the above negatives. Attempts to rally met with sizeable sell orders. The S&P 500 lost its hold on the 4,500 mark while the NASDAQ Composite fell below 14,000. The S&P 500 joined the NASDAQ Composite in falling below its psychologically important 200-day moving average.

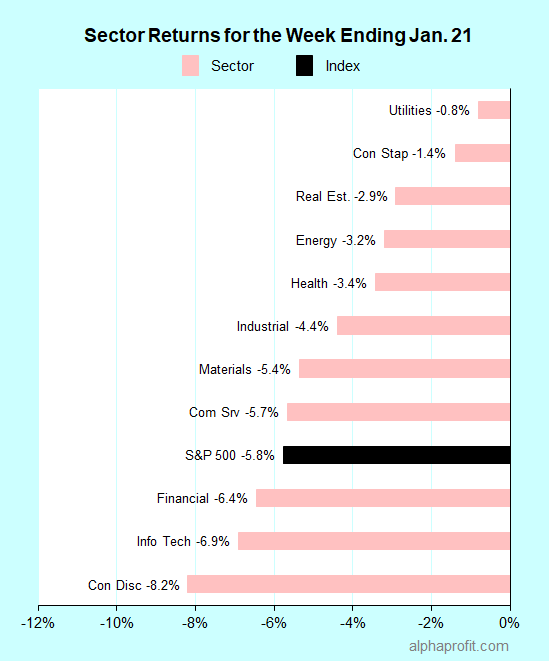

For the week ending January 21, the S&P 500 (SPY) fell 5.8%. None of the 11 sectors gained.

Market breadth was overwhelmingly negative. The number of declining stocks in the S&P 500 exceeded the number of advancers by nearly 20-to-1.

Defensive sectors utilities (XLU), consumer staples (XLP), and real estate (XLRE) held up better than the S&P 500, losing 2.9% or less.

Consumer discretionary (XLY), information technology (XLK), and financials (XLF) lagged the S&P 500, losing 6.4% or more.

The S&P 500’s top 10 winners included three communication services companies. The remaining seven winners were split evenly across seven sectors.

1. Communication Services

Activision Blizzard (ATVI) surged 24%, becoming the top performer in the S&P 500 for the week after Microsoft offered $69 billion for the gaming software maker. Other gaming software makers, Take-Two Interactive Software (TTWO) and Electronic Arts (EA), rose 8% and 7%, respectively, on the possibility of attracting buyout offers.

2. Information Technology

Citrix Systems (CTXS) +6% – The enterprise software firm jumped 6% after Bloomberg reported Elliott Investment Management and Vista Equity Partners are in advanced talks to buy Citrix.

3. Materials

Newmont Mining (NEM) +2% – The gold miner gained after gold rose 0.8% for the week, and competitor Barrick Gold reported production in line with forecasts incurring lower than expected costs.

4. Consumer Discretionary

Las Vegas Sands (LVS) +2% – The casino resort operator extended its gains from the previous week, ending the week 2% higher. UBS upped the stock’s rating from Neutral to Buy, citing a better outlook for casinos in Macau.

5. Real Estate

Prologis (PLD) +2% – The industrial REIT reported 18% growth in its funds from operations in the fourth quarter of 2021 and forecasted above-average growth for the future.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Consumer staples giant Procter & Gamble (PG) +2%

- Futures and options exchange CME Group (CME) +1%

- Medical technology company Hologic (HOLX) +1%

Top ETFs for the week

The following ETFs themes worked well: volatility, platinum, silver, precious metals, and Brazil. The top ETFs for the week include:

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +25.7%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) +6.2%

- iShares Silver Trust (SLV) +5.6%

- Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) +3.7%

- iShares MSCI Brazil ETF (EWZ) +2.8%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +2.0%

Looking ahead to the week of January 24

Having fallen below its 200-day moving average, the S&P 500 can either fall further or redeem itself from events this week. The week’s key event is the Federal Reserve’s two-day interest rate policy meeting. A big week awaits investors on the earnings front too. Investors also get an early read into the economy’s growth in the fourth quarter and an update on inflation.

* Last week, the S&P 500 broke its 200-day moving average when it fell below 4,430 last Friday to close the week at 4,398. Investors are now waiting to see if the benchmark sinks further or finds enough buying interest to rebound above this trendline. As described below, many events can impact the outcome this week.

* The Federal Reserve meets on Tuesday and Wednesday to discuss interest rate policy. This meeting is the focal event of the week. Economists do not expect the Fed to raise interest rates or change policy at this meeting. Investors are looking for more guidance on the central bank’s plan to tighten interest rate policy, including the magnitude of the interest rate increase in March and plans to shrink the Fed’s $9 trillion balance sheet.

* The fourth-quarter earnings season steps into a higher gear this week. Two trillion-dollar companies in Apple and Microsoft report this week. Other notable names reporting earnings include Chevron, Johnson & Johnson, Mastercard, Tesla, and Visa.

* The Commerce Department’s Bureau of Economic Analysis releases its preliminary reading on U. S. economy growth in the fourth quarter. Briefing.com shows economists’ consensus estimate for the economy to grow at a 5.6% annualized rate in the fourth quarter, up from 2.3% in the third. The Bureau also reports the December personal consumption expenditures index, the Fed’s preferred inflation measure. Economists expect the core-PCE excluding food & energy prices to increase 0.4% in December, down from 0.5% in November.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023