Investor sentiment shifted dramatically during the short trading week. Investors grappled with worries of a global economic slowdown as inflation concerns gave way.

Investors swapped fears of runaway inflation with worries of a rapid slowdown in global economic growth during the holiday-shortened trading week.

Worries rose on the highly contagious COVID delta variant, pegging back the global economic rebound. Japan declared a state of emergency in Tokyo to curb the spread of coronavirus. The Olympics organizers responded by banning spectators at the Tokyo summer games scheduled from July 23 to August 8.

Economic data also sparked concerns about the strength of the U. S. economy. The Institute of Supply Management’s services activity measure fell to 60.1 in June from its May record, exceeding economists’ forecast. Weekly unemployment claims unexpectedly rose by 2,000 compared to economists forecast for a 20,000 decline.

Minutes of the Federal Open Market Committee’s June 15-16 meeting suggested officials may not be ready yet to tighten monetary policy.

After starting the week at 1.43%, the yield on the 10-year Treasury bond fell as low as 1.27% as worries of a global economic slowdown gripped investors.

A ‘buy the dip’ mentality pervaded the stock market on Friday. The resulting rally enabled the broad U. S. stock indexes to reverse earlier losses and end above the flat-line for the week.

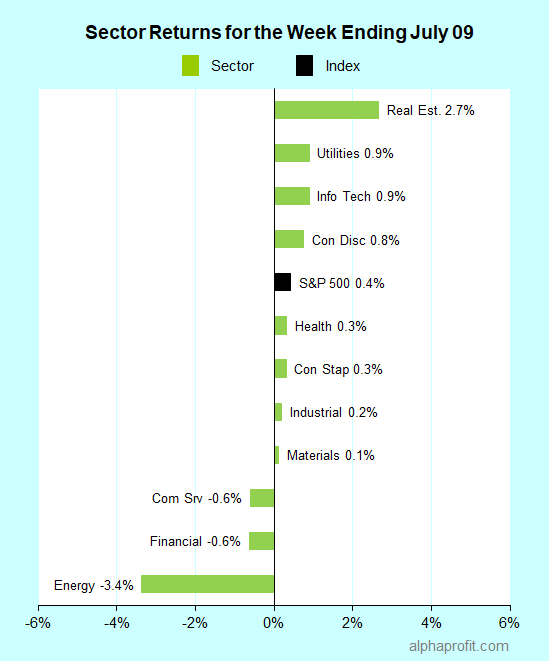

For the week ending July 9, the S&P 500 (SPY) rose 0.4%. Eight of the 11 sectors gained.

Real estate (XLRE), utilities (XLU), and information technology (XLK) led the S&P 500, gaining 0.9% or more.

Energy (XLE), financials (XLF), and communication services (XLC) lagged the benchmark.

Market breadth was barely positive. The number of advancing stocks in the S&P 500 led the number of decliners by a modest 14-to-11 ratio.

Information technology, consumer discretionary, and real estate companies collectively accounted for nine of the S&P 500’s top 10 winners. The winner list also included one industrial company in Generac (GNRC).

1. Information Technology

Oracle (ORCL) +7% – The enterprise software company was the week’s top performer in the S&P 500. Oracle shares surged on speculation the company may win a part of the Defense Department’s new cloud computing contract after the DoD canceled the $10 billion cloud computing contract previously awarded to Microsoft. Oracle (ORCL) and Amazon.com (AMZN) had challenged the award in court.

2. Consumer Discretionary

Amazon.com (AMZN) +6% – The company entered into a content deal with Comcast allowing Amazon’s streaming video services Prime Video and IMDb TV to carry content from Hollywood heavyweight Universal. Investors also warmed up to the possibility of Amazon’s web services unit getting a piece of the DoD’s new cloud computing contract.

3. Real Estate

Real Estate Investment Trusts (REITs) accounted for seven of the top 10 winners. Apartment owners Mid-America Apartment Communities (MAA), Essex Property Trust (ESS), and AvalonBay Communities (AVB) rose 5-6% each after RBC Capital Markets upped the price targets citing lower capitalization rates and higher funds from operations. Apartment REITs UDR, Inc. (UDR) and Equity Residential (EQR) joined the rally, gaining 4-5% each.

Timberland owner Weyerhaeuser (WY) and industrial properties owner Duke Realty (DRE) also featured among the top winners, rising 4% each.

Top ETFs for the week

The following ETFs themes worked well: rare earths, lithium & batteries, online retail, cybersecurity, and REITs. The top ETFs for the week include:

- VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) +13%

- Global X Lithium & Battery Tech ETF (LIT) +9%

- ProShares Online Retail ETF (ONLN) +6%

- First Trust NASDAQ Cybersecurity ETF (CIBR) +3%

- iShares Cohen & Steers REIT ETF (ICF) +3%

Top Fidelity Fund for the week

- Fidelity Real Estate Investment (FRESX) +2.7%

Looking ahead to the week of July 12

There is plenty for investors to look forward to this week. The second-quarter earnings reporting season kicks off amidst expectations for high year-over-year earnings growth. The economic calendar is also busy with investors getting a look at both inflation and growth measures.

* The second-quarter earnings report season kicks off this week. Analysts expect S&P 500 to grow EPS 64% year-over-year on average, the highest on record since the fourth quarter of 2009. The focus is on financials this week with JPMorgan Chase, Bank of America, Wells Fargo, Morgan Stanley, Citigroup, and Goldman Sachs reporting. The earnings calendar includes reports from non-financial firms such as UnitedHealth, PepsiCo, Delta Air Lines, and Alcoa.

* Investors will get a read on inflation this week. The June consumer price index (CPI) comes out on Tuesday. According to Briefing.com, economists’ consensus estimate sees the total CPI increasing 0.5% in June, a tad slower than 0.6% in May. The producer price index (PPI) follows the CPI on Wednesday. The PPI provides a perspective on inflation in wholesale prices.

* As for growth indicators, the Commerce Department’s Census Bureau reports June retail sales on Friday. Economists expect the decline in retail sales to moderate to 0.6% in June from 1.3% in May. Investors will also focus on the number of initial unemployment claim filings after they unexpectedly rose last week. Economists expect claims to decline by 13,000.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023