U. S. economic data comforted investors. The ISM’s factory and services activity measures showed the economy gaining traction. Job creation in May was neither too strong nor too weak. Investors believed the May jobs support would support the Fed in prolonging the near-zero interest rate policy.

The Labor Department reported the U. S. economy created 559,000 jobs in May. The tally fell short of the Wall Street consensus estimate for a gain of 671,000, based on a poll of economists by Dow Jones and The Wall Street Journal. The unemployment rate declined to 5.8% from 6.1% in April.

Perceiving job creation to be neither too weak nor too hot, investors surmised the report would encourage the Federal Reserve to keep its near-zero interest rate policy longer.

In other economic data, the Institute for Supply Management (ISM) reported that its services activity index rose to an all-time high of 64.0 in May. The ISM’s manufacturing activity index increased to 61.2.

Pent-up demand in a reopening economy boosted the backlog of orders measure in both the services and manufacturing activity indexes. Bottlenecks in the supply chain compelled both manufacturers and service providers to pay more for inputs.

President Biden signaled his willingness to make concessions to Republicans on corporate taxes to forge a deal on infrastructure spending. Giving a boost to reopening plays, the Centers for Disease Control and Prevention said more than half of the adults in the U. S. have received both COVID vaccine doses.

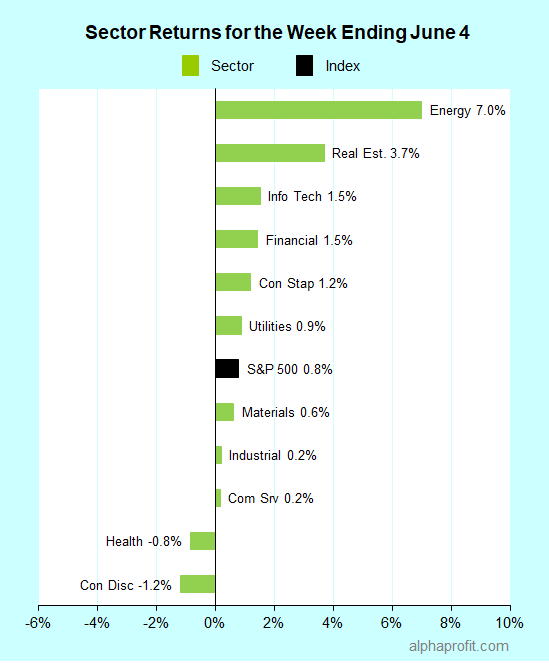

For the week ending June 04, the S&P 500 (SPY) rose 0.8%. Nine of the 11 sectors gained.

Energy (XLE), real estate (XLRE), and information technology (XLK) gained over 1.5% to lead the S&P 500.

Consumer discretionary (XLY), health care (XLV), and communication services (XLC) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 beat the number of decliners by a 16-to-9 ratio.

Eight of the S&P 500’s top 10 winners were energy sector members. The winner list also included one member each from the information technology and consumer discretionary sectors.

1. Energy

The Organization of the Petroleum Exporting Countries and their allies (a group known as OPEC+) raised its oil demand forecast. The group also agreed to increase output by 450,000 barrels a day, starting July, as previously planned. Saudi Arabia planned to roll back part of the 1 million barrels per day production it voluntarily cut. Oil gained 5% for the week on the restraint shown by OPEC+ in increasing production in the face of surging demand. Shares of oil & gas producers and energy services companies took their cue from oil.

Devon Energy (DVN) +19% – The oil & gas producer was the top performer in the S&P 500 for the week. Its shares surged after Raymond James upgraded them to ‘Strong Buy’ and raised the price target by 17% to $40 a share. Raymond James based the upgrade on opportunities for productivity gains in Devon Energy’s Delaware wells.

Oil & gas producers Marathon Oil (MRO), APA Corp. (APA), Pioneer Natural Resources (PXD), and Occidental Petroleum (OXY) also featured among the top 10 winners list after gaining 12-14% each.

Schlumberger (SLB) +16% and Halliburton (HAL) +10% – Schlumberger’s provided an upbeat assessment of the future of the energy services industry. Schlumberger also raised its full-year revenue and operating margin forecasts.

2. Information Technology

NVIDIA Corp. (NVDA) +8% – The semiconductor chip maker features in this column for a second straight week. NVIDIA unveiled its latest gaming processors and initiatives to broaden the availability of its artificial intelligence technology. NVIDIA’s CEO said he is confident regulators will approve his company’s $40 billion acquisition of ARM Ltd. from SoftBank Group.

3. Consumer Discretionary

eBay Inc. (EBAY) +10% – The peer-to-peer marketplace operator gained after the regulator in the U. K. approved eBay sale of its classified advertisements business to Norway-based Adevinta for $9 billion. The approval keeps the transaction on track to close in the second quarter.

Top ETFs for the week

The following ETFs themes worked well: energy groups such as energy services, natural gas, and oil & gas producers, reopening plays, and Brazil. The top ETFs for the week include:

- VanEck Vectors Oil Services ETF (OIH) +14.9%

- Invesco Dynamic Leisure and Entertainment ETF (PEJ) +11.6%

- First Trust Natural Gas ETF (FCG) +9.5%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +8.3%

- iShares MSCI Brazil ETF (EWZ) +7.1%

Top Fidelity Fund for the week

- Fidelity Select Energy Service (FSESX) +14.1%

Looking ahead to the week of June 7

With the earnings reporting season relatively quiet, investors will focus on economic data ahead of the upcoming Fed meeting on June 15-16. Consumer price data will be in the spotlight this week.

* Bureau of Labor Statistics reports the consumer price index for May on Thursday. Economists surveyed by Dow Jones expect core inflation to rise 0.4% for the month and 3.4% year-over-year. The headline CPI is forecasted to show a year-over-year increase of 4.7%, up from 4.2% in April.

* The U. S. financial markets will have their first opportunity to react to the seven developed countries agreeing to a 15% minimum global tax rate. The finance ministers of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States (G-7) met in England last Saturday. They agreed to enact a floor on the taxes paid by corporations worldwide. This international tax agreement strengthens the White House’s position on lifting domestic corporate tax rates without pushing multinationals abroad. President Biden will attend the G-7 leaders meeting in England on Friday.

* Consumer staples companies Brown-Forman and Campbell Soup are among the S&P 500 member reporting earnings this week. Popular meme name GameStop reports as well.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023