The S&P 500 broke its string of back-to-back weekly losses as cryptocurrencies stabilized and pressure from the pandemic eased further. Investors were unfazed by the larger-than-expected increase in inflation after many Fed officials assured the uptick would be transitory. Re-opening trades and growth stocks fared well during the past week.

Pressure on stock prices from crashing cryptocurrencies eased last week as cryptos stabilized. Bitcoin closed the week at $34,300 after trading below $32,000 early last week.

The pressure from the pandemic continued to ease in the U. S., giving re-opening trades a boost. The success of immunization programs pushed the seven-day average of daily new COVID cases below 25,000.

The core personal consumption expenditures (PCE) index rose 3.1% year-over-year in April. The increase in inflation topped the Federal Reserve’s 2.0% target and exceeded economists’ forecast. It also marked the fastest rise in the core PCE since 1992. Yet, the inflation data did not bother investors.

Many Federal Reserve officials consistently assured investors that the central bank views the rise in inflation as transitory. They assured investors the central bank has the tools to clamp down if inflation begins to run too hot. They also edged closer to starting the discussion on scaling back bond purchases.

Senate Republicans unveiled a $928 billion infrastructure proposal to counter President Biden’s $1.7 trillion plan. Investors saw the Senate proposal as a precursor to a smaller infrastructure bill.

The assurances from Fed officials and the likelihood of a smaller infrastructure bill helped the yield on the 10-year Treasury bond trend lower last week, boosting growth stocks.

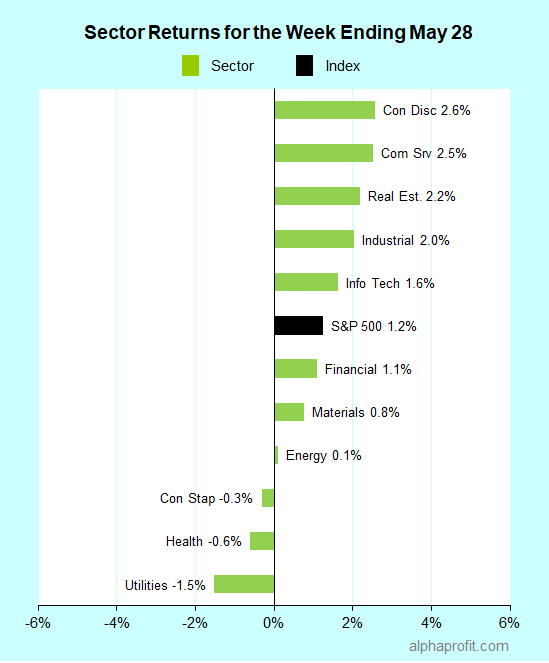

For the week ending May 28, the S&P 500 (SPY) rose 1.2%. Eight of the 11 sectors gained.

Consumer discretionary (XLY), communication services (XLC), and real estate (XLRE) gained over 2.0% to lead the S&P 500.

Utilities (XLU), health care (XLV), and consumer staples (XLP) lagged the benchmark.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 7-to-3 ratio.

Seven of the S&P 500’s top 10 winners were consumer discretionary sector members. The winner list also included companies from the healthcare, industrial, and information technology sectors.

1. Consumer Discretionary

Cruise and casino operators battered by the pandemic surged as the average daily number of new COVID cases declined and the percentage of U. S. adults receiving at least one dose of the vaccine approached 50%.

Royal Caribbean (RCL) +13% – The cruise operator was the top performer in the S&P 500 for the week. The company received approval to begin test cruises with volunteer passengers. Competitors Norwegian (NCLH) and Carnival (CCL) rose 11% and 9%, respectively. Casino operator MGM Resorts International (MGM) gained 8%.

Ulta Beauty (ULTA) +9% – The beauty products retailer rallied after posting first-quarter sales and EPS above analysts’ forecasts. Ulta also raised its fiscal 2021 sales guidance.

L Brands (L) +8% – The retailer moved one step closer to spinning off its Victoria’s Secret business in August. It appointed Chief Financial Officers for its standalone Bath & Body Works and Victoria’s Secret businesses.

Ford Motor (F) +9% – The automaker features in this column for a second straight week after unveiling its ambition is to lead the electric car revolution. Ford’s goal is to make 40% of its global volume “all-electric” by 2030.

2. Information Technology

NVIDIA Corp. (NVDA) +8% – The semiconductor chip maker surged in a delayed reaction to its beat-and-raise quarter as investors took a more optimistic view of its expansion potential after bullish comments from analysts.

3. Health Care

DexCom (DXCM) +8% – Positive comments from Barclays and Wells Fargo boosted shares of the glucose monitoring products manufacturer.

4. Industrials

TransDigm Group (TDG) +8% – Aircraft maker Airbus disclosed robust production plans that sparked a broad rally in aerospace stocks and lifted shares of this aerospace component maker.

Top ETFs for the week

The following ETFs themes worked well: cannabis, leisure, blockchain, rare earths, and lithium. The top ETFs for the week include:

- Global X Cannabis ETF (POTX) +15.5%

- Invesco Dynamic Leisure and Entertainment ETF (PEJ) +7.6%

- Amplify Transformational Data Sharing ETF (BLOK) +7.5%

- VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) +7.1%

- Global X Lithium & Battery Tech ETF (LIT) +6.7%

Top Fidelity Fund for the week

- Fidelity Select Semiconductors (FSELX) +5.2%

Looking ahead to the week of May 31

U. S. financial markets are closed on Monday in observance of the Memorial Day holiday. Investors will focus on economic data and the Fed during this shortened trading week.

* The week kicks off on Tuesday with the Institute of Supply Management’s reading on U. S. manufacturing activity in May. The ISM also reports its services sector index on Thursday.

* The May employment report is the big event of the week. Economists surveyed by Dow Jones, on average, expect the Labor Department to report the creation of about 674,000 jobs in May on Friday. In April, the economy added just 266,000 jobs, just one-quarter of what economists forecasted.

* The May jobs report is likely to be important from two perspectives. First, the data should help investors ascertain if the disappointing April jobs report was an aberration. Second, it is likely to strongly influence the Federal Reserve in shaping monetary policy in light of the surge in core personal consumption expenditures seen last Friday.

* Fed Chairman Powell speaks on Friday about central banks and climate change at the Green Swan 2021 global virtual conference.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023