The stock market abruptly changed course after the Federal Reserve increased its inflation forecast and brought forward its timetable for raising interest rates. A flattening yield curve and falling commodity prices weighed heavily on value stocks, the leaders of the rally this year. Investors rotated into growth stocks buoyed by a decline in long-term bond yields.

The Federal Reserve surprised investors after the interest rate policymaking Federal Open Market Committee met on June 15 and 16. Fed officials indicated interest rates could go up as soon as 2023, more than a year earlier than their March forecast.

The Fed acknowledged the rapid economic recovery from the pandemic and raised its 2021 GDP growth forecast by 0.5% to 7.0%. The Fed also raised its 2021 inflation forecast by 1.0% to 3.4%. The FOMC left its benchmark short-term borrowing rate anchored near zero. The FOMC discussed tapering bond purchases; it, however, stopped short of providing a timetable.

St. Louis Federal Reserve President Bullard further unnerved investors two days after the FOMC meeting. Bullard said he thinks the Fed should lift its benchmark interest rate as early as late 2022. He also voiced his support for ending purchases of mortgage-backed securities.

Stocks swooned, and the dollar surged on Bullard’s comments. Value stocks such as financials and materials bore the brunt of the decline.

Financial stocks came under pressure as the yield curve flattened. Yields on longer duration 10- and 30-year bonds fell while yields on shorter duration 2- and 5-year notes rose.

The rise in the U.S. dollar and data from China weighed on commodities and materials stocks. Copper and gold declined 9% and 6%, respectively. China’s credit impulse, which measures the growth in new financing as a share of GDP, contracted sharply in May. Adding to pressure on commodities, Reuters reported China plans to release metal reserves to nip commodity price inflation.

Before the FOMC meeting, economic data pointed to rising inflation and moderating growth. Producer prices rose 6.6% for the 12 months ending in May, a record high for this data set. Retail sales fell by a larger-than-expected 1.3% in May while initial unemployment claims unexpectedly rose.

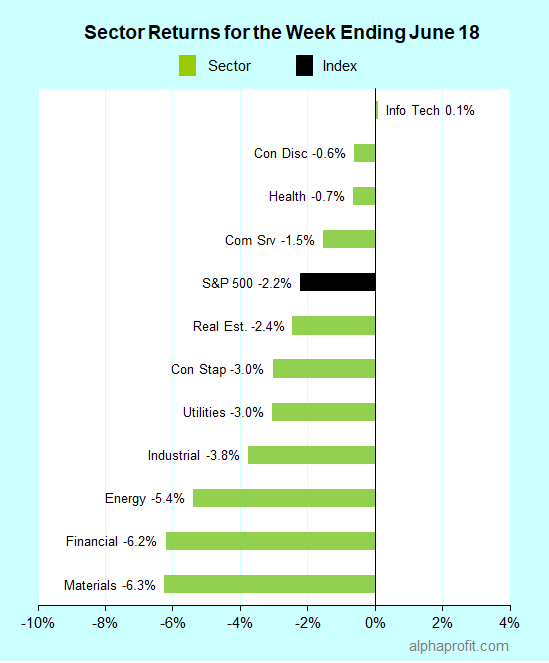

For the week ending June 18, the S&P 500 (SPY) fell 2.2%. Only one of the 11 sectors gained.

Information technology (XLK) bucked the broad decline with a 0.1% gain. Consumer discretionary (XLY), health care (XLV), and communication services (XLC) held up better than the S&P 500.

Materials (XLB), financials (XLF), and energy (XLE) lagged the benchmark losing more than 5.0% each.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 2-to-11 ratio.

Health care and information technology companies collectively accounted for seven of the S&P 500’s top 10 winners. The winner list also included one member each from the industrials, consumer discretionary and financial sectors.

1. Information Technology

Enphase Energy (ENPH) +13% – The renewable energy technology company features here for a second straight week. Enphase shares rallied as part of the growth stock universe as long-term interest rates fell. They were the top performer in the S&P 500 for the week.

ServiceNow (NOW) +7% – The enterprise software company extended its rally from the week of June 7.

NVIDIA Corp. (NVDA) +5% – Bank of America and Jefferies raised their share price targets for the semiconductor chipmaker.

Adobe (ADBE) + 5% – The software company’s earnings report and outlook enthused traders building positions ahead of the event. Adobe raised its current quarter sales and EPS forecasts after beating analysts’ estimates for the second quarter by 3% and 8%, respectively.

2. Industrials

Generac Holdings (GNRC) +11% – The momentum in the power generation equipment maker continued from the week of June 7. California utility PG&E warned customers to expect more power outages this summer. Electricity grids in CA and TX felt the strain of the brutal heatwave.

3. Health Care

ResMed (RMD) +9% – The medical equipment maker bucked a downgrade from Bank of America after Dutch competitor Koninklijke Philips recalled ventilation devices, allowing ResMed to gain market share.

Abiomed (ABMD) +6% – Deutsche Bank initiated coverage of the medical device maker with a $360 a share price target, implying a 15% upside.

(DXCM) +5% – Piper Sandler retained DexCom as a top pick in diabetes Medicare’s qualification rule to cover continuous glucose monitoring devices eases after July 18.

4. Consumer Discretionary

Lennar (LEN) +6% – J. P. Morgan raised its share price target for Lennar by 23% to $141 a share after the homebuilder beat analysts’ quarterly sales and EPS forecasts and the dollar value of its backlog surged 56%.

4. Financial

MSCI Inc. (MSC) +5% – Oppenheimer upped its share price target for the global securities index publisher by $10 to $543 a share. Reuters reported MSCI is looking to launch indexes for cryptocurrency assets.

Top ETFs for the week

The following ETFs themes worked well: volatility, cloud computing, long-term treasuries, solar energy, and fintech. The top ETFs for the week include:

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +13%

- WisdomTree Cloud Computing Fund (WCLD) +5%

- Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV) +4%

- Invesco Solar ETF (TAN) +3%

- ARK Fintech Innovation ETF (ARKF) +3%

Top Fidelity Fund for the week

- Fidelity Select Disruptive Technology (FTEKX) +2.5%

Looking ahead to the week of June 21

Comments from the Fed on inflation and interest rates will dominate the market this week after the gyrations last week. Data on inflation and the housing market will also be in focus. Investors will look to gauge the economy from three high-profile earnings reports.

* The markets will receive plenty of inputs from Federal Reserve officials this week. On Tuesday, Chairman Powell speaks to the House Select Subcommittee about the coronavirus crisis policy response and the economy. This communication allows Powell to calm investors. Presidents of several Federal Reserve Districts will speak this week as well.

* The Commerce Department’s Bureau of Economic Analysis reports the personal consumption expenditures (PCE) inflation index for May on Friday. The PCE is the Fed’s preferred inflation measure.

* Housing data will also be of interest to investors. Last week, comments from the Federal Reserve caused the 30-year fixed mortgage rate to jump 0.23% to 3.26%, according to data from the Mortgage News Daily. Data on existing home sales and new home sales are due this week.

* In earnings news, investors will focus on reports from three bellwethers Accenture, FedEx, and Nike, to assess the health of IT services, manufacturing, and the consumer worldwide.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023