President Biden signed a $1.9 trillion pandemic relief bill into law. Inflation worries eased on tame price data. Adequate demand for 10-year and 30-year bonds auctioned by the U. S. Treasury kept bond yields in check. Stock prices rose to new highs amidst this positive backdrop.

President Biden signed a $1.9 trillion coronavirus relief package, called the American Rescue Plan Act of 2021, into law on Thursday. The plan includes direct payments of up to $1,400 to most Americans. It also includes $350 billion in assistance for state & local governments and $20 billion for vaccinations.

Data for the Labor Department eased inflation worries. The data showed consumer and producer price indexes rose 0.4% and 0.5%, respectively in February, in line with economists’ forecasts. The CPI and PPI were up 1.7% and 2.2%, respectively on an annualized basis.

The U. S. Treasury auctioned $120 billion on bonds last week. Buying interest in the closely watched 10-year and 30-year bond auctions was adequate.

Tame inflation and a satisfactory Treasury auction helped the yield on the 10-year bond to fall as low as 1.50% after starting the week at 1.55%. The yield, however, spiked to close the week at 1.64% after the stimulus plan was approved.

Stocks took their cue from the bond market. Growth stocks such as the pandemic favorites fared well as bond yields declined. Value stocks positioned to benefit from the re-opening of the economy rallied as bond yields rose.

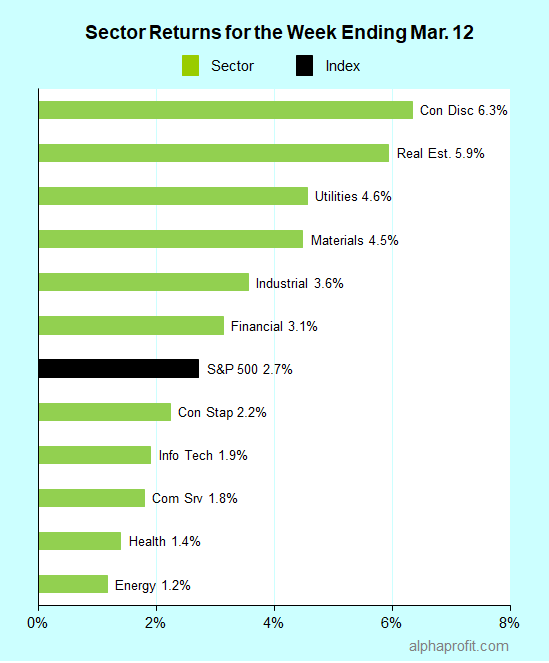

For the week ending March 12, the S&P 500 (SPY) rose 2.7%. All of the 11 sectors advanced.

Consumer discretionary (XLY), real estate (XLRE), and utilities (XLU) led the S&P 500.

Energy (XLE), health care (XLV), and communication services (XLC) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 beat the number of decliners by a 7-to-1 ratio.

Communication services, industrial, and consumer discretionary companies accounted for seven of the S&P 500’s top 10 winners. Members of the consumer staples and information technology sectors rounded out the top 10.

1. Communication Services

Broadcaster shares were in the limelight for a second straight week. ViacomCBS (VIAC) shares rose 28% to claim the top spot among the S&P 500’s winners for the week. Discovery (DISCA) shares were up 13%.

ViacomCBS said Oprah Winfrey’s interview with Prince Harry and Meghan Markle drew 17 million viewers. Short covering also supported the rally in ViacomCBS shares with 19% of its shares sold short.

2. Industrials

Airline stocks were the bright spot among industrials. Shares of Boeing (BA) surged 21% after the aircraft manufacturer confirmed investment firm 777 Partners will buy 24 of its 737 MAX jets. Boeing was also reported to be working on a deal with Southwest Airlines for several dozens of the 737 MAX.

American Airlines (AAL) and United Airlines (UAL) shares were up 14% and 11%, respectively on optimism of vaccine rollouts leading to an increase in travel. Airlines are also set to receive $14 billion in aid from the American Rescue Plan Act of 2021.

3. Consumer Discretionary

Shares of electric car maker Tesla (TSLA) rebounded 16% from recent losses. The shares lost close to 38% from February 3 to March 5 as rising bond yields lowered the present value of the company’s far-out profits. ‘Dip’ buyers got in as bond yields trended lower last week.

Shares of apparel store Gap (GPS) added 13% to their previous week’s gains. They rallied as part of the retail group on expectations Americans would spend part of the $1,400 stimulus payment in retail stores. In the prior week, Gap topped analysts’ quarterly EPS forecasts by 55% and projected fiscal 2021 sales to rise mid-to-high teens.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Solar energy company Enphase Energy (ENPH) 15%

- Drug retailer Walgreens Boots Alliance (WBA) 13%

- IT security and services provider Fortinet (FTNT) 12%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Amplify Transformational Data Sharing ETF (BLOK) 17%

- SPDR S&P Retail ETF (XRT) 16%

- Invesco WilderHill Clean Energy ETF (PBW) 15%

- ETFMG Alternative Harvest ETF (MJ) 13%

- iShares Micro-Cap ETF (IWC) 11%

Looking ahead to the week of March 15

The rollout of vaccines and the passage of the American Rescue Plan Act of 2021 have kept the attention of U. S. financial markets on inflation and bond yields. This focus will continue next week with inputs from the Federal Reserve Open Market Committee’s interest rate policy meeting. Meanwhile, some countries in Europe and Asia are battling a resurgence in COVID-19 cases. Growth stocks may lead value stocks this week if the Fed calms interest rate fears and restrictive measures are reintroduced abroad to stem the spread of COVID-19.

* The yield on the 10-year Treasury bond has surged by nearly 0.5% in the past four weeks to 1.64%. The Federal Reserve Open Market Committee meets to discuss U. S. interest policy on March 16 and 17. Investors are eagerly looking to what the Fed has to say on inflation and interest rates. Demand for 20-year notes auctioned by the U. S. Treasury and February retail sales data are also likely to have a bearing on bond yields this week.

* The Federal Reserve has allowed banks to hold Treasury bonds without counting them against the bank’s leverage ratio to provide more flexibility to banks and support the economic recovery since the pandemic. This program is set to end on March 31. It remains to be seen if the Fed will share its thoughts on continuing this program. Bank stocks are likely to react negatively if the Fed decides to pull the plug.

* Over the past four weeks, Germany, India, and Italy have seen a resurgence in the number of daily new COVID-19 cases. Italy is considering a lockdown for Easter while Germany is concerned about a ‘third COVID-19 wave’. Investors will look to earnings from transportation giant FedEx (FDX) and apparel leader Nike (NKE) to get a sense of the global economy.

* Growth stocks may hold the advantage over value stocks this week if the Fed calms worries of spiraling interest rates and restrictive measures are reintroduced abroad to stem the spread of COVID-19.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023