The Federal Reserve raised its projection for U. S. economic growth and inflation this year. Yet, the central bank repeated its pledge to keep its target interest rate near zero for a few years. The Fed also decided to let an exemption it provided to banks during the pandemic end on March 31. Stocks succumbed as bond yields resumed their rise after comments from the Fed.

The Federal Reserve raised its forecast for U. S. gross domestic product growth in 2021 to an annualized rate of 6.5%, the strongest since 1984. In December, the Fed had forecasted U. S. GDP to grow 4.2% in 2021.

The central bank also raised its inflation forecast. It now expects inflation to exceed its 2.0% target in 2021 and hit 2.4% by the end of the year before falling back in 2022. In apparent odds with the Fed’s dual mandate of ‘stable prices’ and ‘maximum employment’, Chairman Powell said the Fed is willing to let inflation overshoot its 2.0% target to prioritize economic recovery and unemployment.

The bond market interpreted Powell’s comment as a green light for yields on longer-maturity bonds to move higher. The yield on the 10-year Treasury note rose 0.1% last week to close at 1.73%, its highest since January 2020. The 30-year Treasury bond’s yield hit 2.5% for the first time since July 2019.

On Friday, the Federal Reserve said it would allow a pandemic period exemption given to banks to expire on March 31. The exemption allows banks to exclude Treasury assets and deposits with the central bank from the supplementary leverage ratio, a capital measure of the bank. This decision triggered a decline in bank stocks.

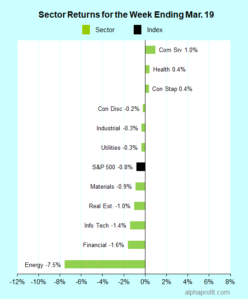

For the week ending March 19, the S&P 500 (SPY) fell 0.8%. Eight of the 11 sectors declined.

Communication services (XLC), health care (XLV), and consumer staples (XLP) gained, bucking the S&P 500.

Energy (XLE), financials (XLF), and information technology (XLK) lagged the benchmark.

Market breadth was negative. The number of declining stocks in the S&P 500 beat the number of advancers by a 6-to-5 ratio.

Communication services, consumer discretionary, and industrial companies accounted for six of the S&P 500’s top 10 winners. Financial, health care and utility companies rounded out the top 10.

1. Financials

Hartford Financial (HIG) shares rose 22% to claim the top spot among the S&P 500’s winners for the week. Property & casualty insurer Chubb offered $65 a share, a 13% premium, to acquire smaller rival Hartford Financial in a $23 billion cash-and-stock deal.

2. Communication Services

Shares of Discovery Communications (DISCK) gained 11% to be among the S&P 500’s top 10 winners for the third straight week. The rotation to value stocks, the company’s successful launch of its Discovery+ streaming service, and short covering drove the advance.

Facebook (FB) shares rose 8% after CEO Zuckerberg said his company could benefit from Apple’s new App Tracking Transparency tool. Reports of Facebook working on a children’s Instagram site, developing a wristband to control its ‘smart’ glasses, and rolling out a new newsletter platform added to the gains.

3. Consumer Discretionary

Shares of Lennar Corp. (LEN) jumped 8% after the homebuilder’s quarterly EPS topped analysts’ forecasts by 17%. The company also announced plans to create a joint venture to provide single-family homes for rent.

Shares of commerce website operator eBay (EBAY) and electronics retailer Best Buy (BBY) were up 7% and 6%, respectively after Adobe forecasted 2022 as the first year U. S. online spending would top $1 trillion. eBay also attracted bids for its Korean unit.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Airlines United (UAL) & American (AAL) up 8% and 7%, respectively

- Electric utility PPL Corp. (PPL) up 7%

- Biopharmaceutical company Amgen (AMGN) up 7%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Aberdeen Standard Physical Palladium Shares ETF (PALL) 11%

- WisdomTree Japan Hedged Equity Fund (DXJ) 3%

- VanEck Vectors Junior Gold Miners ETF (GDXJ) 3%

- SPDR S&P Homebuilders ETF (XHB) 3%

- iShares MSCI Brazil ETF (EWZ) 3%

Looking ahead to the week of March 22

Stocks have been taking their cues from the bond market for some time. This is unlikely to change next week. Inputs on interest rate policy and data on inflation are on the cards. The week provides opportunities for Fed Chair Powell to ease worries of rising bond yields. Growth stocks, that have been lagging the broad market, can catch up if Powell succeeds in his communication.

* After speaking at the Bank for International Settlements on Monday, Federal Reserve Chairman Powell testifies with Treasury Secretary Yellen before Congress on Tuesday and Wednesday. These speaking engagements provide Powell the opportunity to clarify how far the Fed is willing to allow bond yields to rise before identifying the move as disorderly. Communication on this dimension can prevent bond yields from rising high enough to find out the central bank’s tolerance threshold.

* The Treasury auctions nearly $60 billion of 7-year Treasury notes. This is the first auction after the Federal Reserve ended the provision allowing banks to exclude Treasuries from the supplementary leverage ratio. This decision is expected to diminish banks’ appetite for owning Treasuries. Wall Street is closely watching the demand for the auctioned notes from banks as well as corporate pension funds and Japanese investors. Poor demand at this auction can sink stocks like it did in February.

* Data on the personal consumption expenditures in February are due at the end of the week. Economists expect core PCE, the Fed’s preferred inflation measure to increase 0.1%, less than 0.3% in January.

* Software titan Adobe (ADBE) is among the few companies reporting earnings. Others include Darden Restaurants (DRI), General Mills (GIS), and IHS Market (INFO).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023