The S&P 500 member companies continued to post robust third-quarter earnings reports. Investors were unfazed by discomforting economic data. President Biden reached a deal on the $1.75 trillion economic & climate change spending bill.

Over 150 S&P 500 members reported their earnings last week. Over 80% of reporting companies, including Alphabet, Coca-Cola, Merck, Microsoft, and United Parcel Service, topped analysts’ forecasts.

The damage from companies that fell short, e.g., Amazon and Apple, was limited and confined. Investors perceived earnings shortfalls resulting from supply chain and labor constraints as ‘business deferred’ rather than ‘business lost’.

Blending actual EPS for those reporting with estimates for those to follow, third-quarter profits are on track to grow 36.6% year-over-year, higher than the 27.5% analysts forecasted on September 30.

Investors took discomforting economic data in stride. The Commerce Department preliminarily estimated the U. S. economy grew at a 2.0% annualized rate in the third quarter, below 2.7% economists, 2.7% forecast. Inflation stayed at a 30-year high. The Federal Reserve’s preferred inflation measure, i.e., the core personal consumption expenditures index, rose 3.6% during the 12 months ending in September.

President Biden announced a deal on a $1.75 trillion economic & climate change spending framework with the backing of all major constituencies on Capitol Hill. This framework should make the passage of the stalled infrastructure spending bill easier.

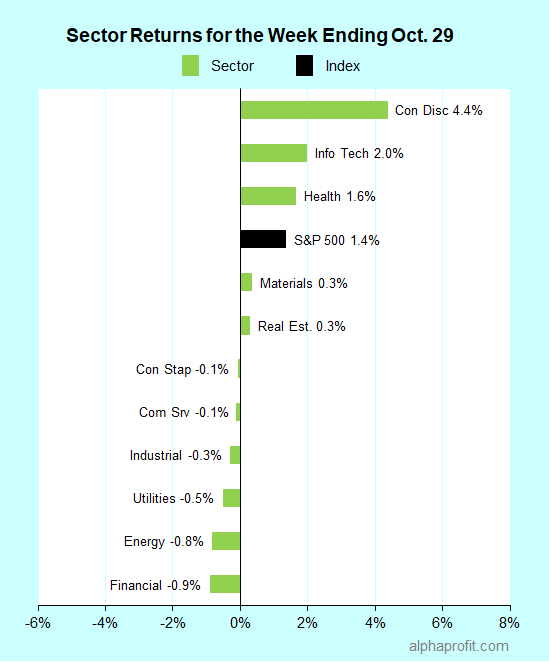

For the week ending October 29, the S&P 500 (SPY) rose 1.4%. Five of the 11 sectors gained.

Consumer discretionary (XLY), information technology (XLK), and health care (XLV) outperformed the S&P 500, gaining 1.6% or more.

Financial (XLF), energy (XLE), and utilities (XLU) lagged the benchmark.

Market breadth was slightly negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 9-to-11 ratio.

The S&P 500’s top 10 winners included consumer discretionary, health care, industrials, information technology and materials companies.

1. Information Technology

Enphase Energy (ENPH) +31% – The maker of microinverters and backup energy storage for solar systems was the top performer in the S&P 500 for the week. Enphase’s third-quarter sales rose 11% from the previous quarter, topping analysts’ forecast by 2%. The company also raised its fourth-quarter revenue forecast to imply growth of at least 11% from the third quarter.

The shortage of semiconductors chips boosted share prices in this group. Semiconductor capital equipment makers Teradyne (TER) and KLA Corp. (KLAC) gained 19% and 11%, respectively, while semiconductor chipmaker NVIDIA Corp. (NVDA) gained 13%.

2. Consumer Discretionary

Tesla (TSLA) +22% – The electric-vehicle maker added 22% to its gains from the prior week. An order for 100,000 Tesla vehicles from Hertz, upgrades from analysts, and continued momentum from Tesla’s stellar third-quarter earnings reported a week ago drove the gains.

3. Health Care

Regeneron Pharmaceuticals (REGN) +12% – The coronavirus delta variant spurred strong demand for the biotech company’s monoclonal antibody-based COVID. Regeneron also reported positive Phase III trial results for Dupixent in treating eosinophilic esophagitis.

DexCom (DXCM), the maker of continuous glucose monitoring systems, and drugmaker Merck (MRK) rose 10% and 9%, respectively, after reporting better-than-expected quarterly earnings.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Water heater and water treatment equipment maker A. O. Smith (AOS) +9%

- Steelmaker Nucor (NUE) +9%

Top ETFs for the week

The following ETFs themes worked well: solar & clean energy, blockchain, semiconductors, and lithium battery technologies. The top ETFs for the week include:

- Invesco Solar ETF (TAN) +12.1%

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) +12.0%

- Amplify Transformational Data Sharing ETF (BLOK) +8.5%

- SPDR S&P Semiconductor ETF (XSD) +6.5%

- Global X Lithium & Battery Tech ETF (LIT) +4.6%

Top Fidelity Fund for the week

- Fidelity Environment & Alternative Energy Fund (FSLEX) +4.9%

Looking ahead to the week of November 01

The Federal Reserve returns to the focal point. Investors expect the central bank to announce its first step in removing extraordinary stimulus measures put in place to fight the pandemic. The third-quarter earnings reporting season enters its final lap. In economic data, the spotlight is on the October jobs report.

* The November 2-3 Federal Reserve meeting on interest rate policy is a big event for financial markets this week. Investors expect the central bank to announce its plan to taper $120 billion in monthly bond purchases. In the past, such announcements have at times sparked a market correction. The Fed’s decision to taper bond purchases should not surprise investors this time. The stock market’s reaction to the announcement will depend on what the central bank says about inflation and the rate at which it plans to reduce bond purchases since they have a bearing on the timing and pace of interest rate increases down the road.

* Another busy week is in store on the earnings front. Nearly 150 S&P 500 members report this week. The reporting companies include large healthcare companies like Amgen, CVS Health, Moderna, and Pfizer. Outside of healthcare, T-Mobile US, Booking Holdings, Estee Lauder, and Qualcomm are on the earnings reporting calendar.

* The October jobs report is due on Friday. According to Briefing.com, economists expect 400,000 in non-farm payroll additions compared to 194,000 in September. They expect the unemployment rate to decline by 0.1% month-over-month to 4.7%.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023