Concerns of the economy losing steam, triggered by the August jobs data on September 3, spilled over to the trading week shortened by the Labor Day holiday. Inflation worries escalated after the producer price index showed a record high annual increase of 8.3% in August. Investors worried the Federal Reserve could decide to scale back stimulus due to inflation concerns just when the economy shows signs of losing vigor.

The U. S. Producer Price Index (PPI) rose 0.7% in August, exceeding the 0.6% forecast of economists surveyed by Dow Jones. The 8.3% increase in the PPI for the 12 months ending in August is the highest rise since the collection of the PPI data began in November 2010.

Investors weighed the increase in the PPI against the backdrop of the weak August jobs data reported on September 3. They worried about the economic recovery losing steam just when the Federal Reserve contemplates scaling back monetary measures used to limit the damage to the economy from the pandemic.

In other developments, the European Central Bank said it would slow down the pace of its bond purchases, elaborating that it can maintain favorable financing conditions with a moderately lower rate of asset purchases than in the previous two quarters.

President Biden stiffened his stance on COVID vaccinations, mandating them for federal employees & contractors. Biden also asked the Labor Department to require all employers with more than 99 employees to either mandate vaccinations or require weekly testing.

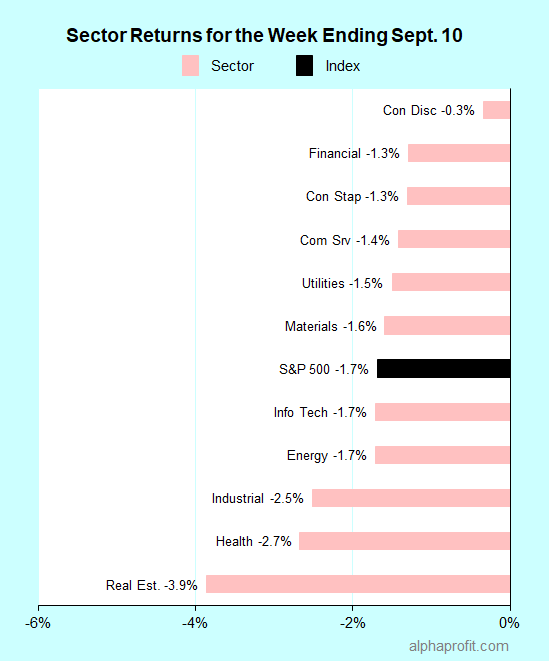

For the week ending September 10, the S&P 500 (SPY) fell 1.7%. All of the 11 sectors declined.

Consumer discretionary (XLY), financials (XLF), and consumer staples (XLP) held up better than the S&P 500, losing 1.3% or less.

Real estate (XLRE), health care (XLV), and industrials (XLI) lagged the S&P 500.

Market breadth was negative. The number of declining stocks in the S&P 500 led the number of advancers by a 5-to-1 ratio.

The S&P 500’s top 10 winners included consumer discretionary, energy, financial, health care, and information technology companies.

1. Health Care

Moderna (MRNA) +13% – The biotechnology company rose 13% to claim honors as the week’s top performer in the S&P 500. The COVID vaccine developer provided its annual research and development update. Moderna said it is developing a single-dose vaccine that includes boosters against both COVID and seasonal flu. Moderna also disclosed a robust drug pipeline, with 37 programs in development, including 22 in clinical trials.

Perrigo (PRGO) +6% – The maker of consumer self-care products announced it is buying HRA Pharma for $2 billion. The purchase adds blister care, women’s health, and scar care products to Perrigo’s portfolio. On September 20, Perrigo will be removed from the S&P 500 index and included in the S&P MidCap 400 index.

2. Consumer discretionary

CarMax (KMX) + 6% – The user-car retailer rallied on news of automobile inventories falling to an all-time low of 136,700 units. Automakers have curtailed production due to the shortage of semiconductor chips.

3. Energy

Cabot Oil & Gas (COG) +6% – The natural gas producer rose 6%, riding the coattails of the commodity. The price of natural gas rose 5% last week. Cabot Oil & Gas featured in this column as the week’s top performer in the S&P 500 for the week ending September 3.

4. Information Technology

Global Payments (GPN) +5% – The payment processing and software solutions provider agreed to buy MineralTree for $500 million. MineralTree provides accounts payable automation and business-to-business payments solutions.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Construction & farm equipment retailer Tractor Supply Company (TSCO) +5%

- Semiconductor manufacturer Analog Devices (ADI) +5%

- Silicon Valley Bank and SVB Leerink parent SVB Financial Group (SIVB) +4%

- Semiconductor capital equipment maker KLA Corp. (KLAC) +4%

- Remote-working software provider Citrix Systems (CTXS) +4%

Top ETFs for the week

The following ETFs themes worked well: uranium, volatility, lithium, China, and rare earths. The top ETFs for the week include:

- Global X Uranium ETF (URA) +10.1%

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +8.5%

- Global X Lithium & Battery Tech ETF (LIT) +3.3%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) +3.1%

- VanEck Rare Earth/Strategic Metals ETF (REMX) +2.9%

Top Fidelity Fund for the week

- Fidelity Japan (FJPNX) +1.8%

Looking ahead to the week of September 13

Threats persist for last week’s decline to continue. This week is all about inflation at the consumer level. With the FOMC meeting just a week away, a higher than expected increase in the CPI could tip the Fed to announce its plan to taper bond purchases after meeting on September 21-22. Congress embarks on a busy legislative schedule.

* The economic calendar this week includes data on consumer price inflation (CPI) and retail sales. Briefing.com shows economists expect the CPI to rise 0.4% month-over-month in August, a tad lower than 0.5% in July. Economists project retail sales to decline 0.7% in August after falling 1.1% in July. These data points take on added importance as they are the last signposts on the economy before the September 21-22 Federal Open Market Committee meeting on interest rate policy. Data suggesting higher inflation, or to a lesser extent, robust growth may tip the Fed to bring forward the timetable for tapering monthly bond purchases.

* Congress has a busy schedule. Lawmakers need to act soon to avert a government shutdown. Democrats also have their task cut out in delivering the infrastructure and social spending package. The U. S. Senate reconvenes on Monday, September 13, after a five-week break. Politics will resume influencing stocks starting this week.

* Enterprise software company Oracle is the only S&P 500 member reporting earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023